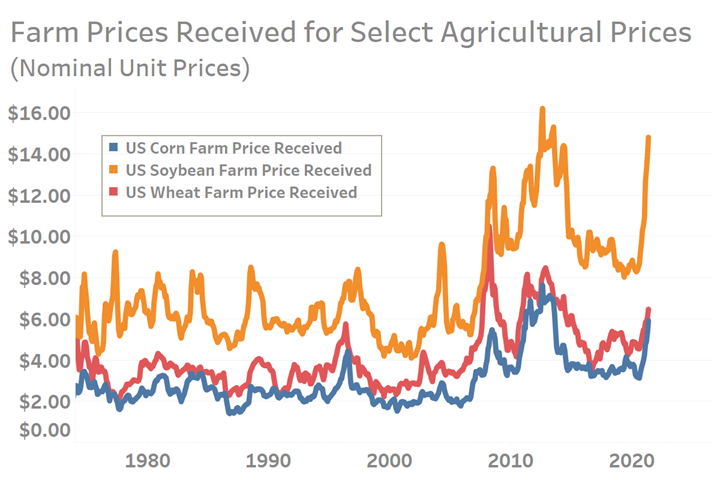

Wide Range of Crop Prices at Multi-Decade Highs Helps Drive Machinery and Equipment New Orders Activity Higher

Prices received by farms for a wide range of staple crops are at multi-year and in some instances multi-decade highs. The increased revenues and associated profits will bolster agriculture machinery and equipment purchases.

In recent months Gardner Intelligence has vocalized to its audience the importance of looking past year-over-year gains in data due to what are called “base effects”. In short, that means favorably viewing recent data by comparing it against a depressed base. Because of such base effects, most recent data series in mid-2021 show remarkable year-over-year growth in either price, quantity or both when compared against the worse depths of the initial COVID lockdowns and the utter halt in economic activity that resulted from government instituted shutdowns.

For agricultural goods, prices have increased drastically with certain crops including corn, grains and cotton nearly doubling from a year ago. Such impressive gains would lead one to first think that this might be the result of deeply depressed prices from a year ago. However, thanks to the fact that market data for many crops goes back over 100 years, it is certain that recent crop prices have not doubled just because of base effects but are in some instances at or near decade-high valuations.

Data Provided by the U.S. Department of Agriculture through May 31st, 2021.

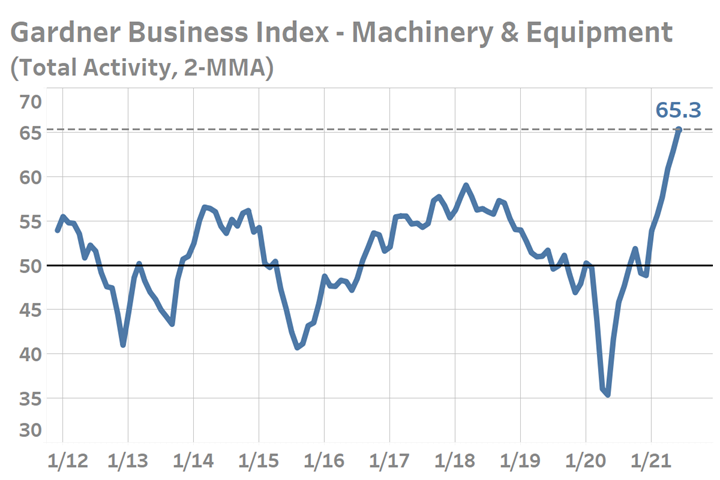

Rising agricultural revenues and profits from historically high prices will support demand for agricultural capital expenditures on farming machinery and equipment. According to the Gardner Business Index (GBI), manufacturers began reporting expanding business activity in the general machinery and equipment market as early as the first quarter of 2021. Between then and the release of the latest available data, new orders activity — which foreshadows activity in production and employment — has never been stronger since at least late-2011 which marks the start of the GBI.

GBI: Machinery and Equipment – Total Activity. Data and image provided by Gardner Intelligence

.jpg;width=70;height=70;mode=crop)