Why Manufacturers Need to Beware of Retailers' Woes

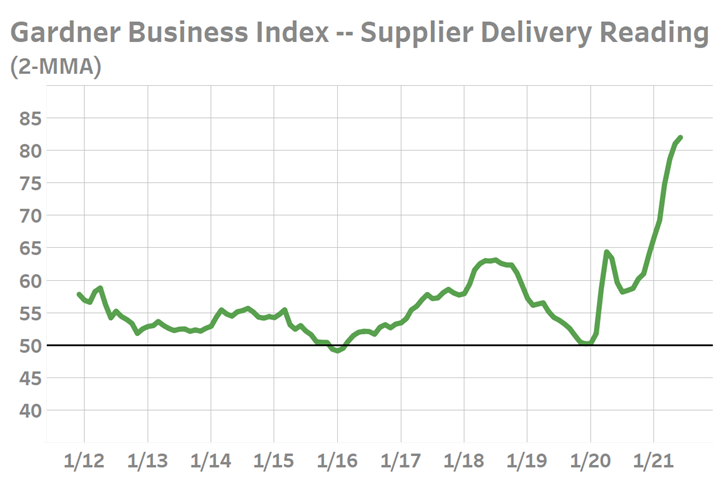

Gardner Intelligence’s supplier delivery data from the Gardner Business Index (GBI) has done a commendable job of monitoring the slipping of order-to-fulfillment times for upstream supplies used in manufacturing. As delivery times have lengthened, readings have correspondingly increased and have done so well beyond anything seen in recorded history. 2021 year-to-date survey data indicate that nearly all surveyed manufacturers in June reported slowing delivery times. In fact, the last 11 months of data have reported almost an unstoppable trend of month-over-month lengthening delivery times. One would think — or at least hope— that the worst must be behind us, right? The GBI: Supplier Delivery reading has reported higher month after month readings almost consistently since July 2020.

Gardner Intelligence’s supplier delivery data from the Gardner Business Index (GBI) has done a commendable job of monitoring the slipping of order-to-fulfillment times for upstream supplies used in manufacturing. As delivery times have lengthened, readings have correspondingly increased and have done so well beyond anything seen in recorded history. 2021 year-to-date survey data indicate that nearly all surveyed manufacturers in June reported slowing delivery times. In fact, the last 11 months of data have reported almost an unstoppable trend of worsening month-over-month delivery performance. One would think — or at least hope— that the worst must be behind us, right?

The GBI: Supplier Delivery reading has reported higher month after month readings almost consistently since July 2020.

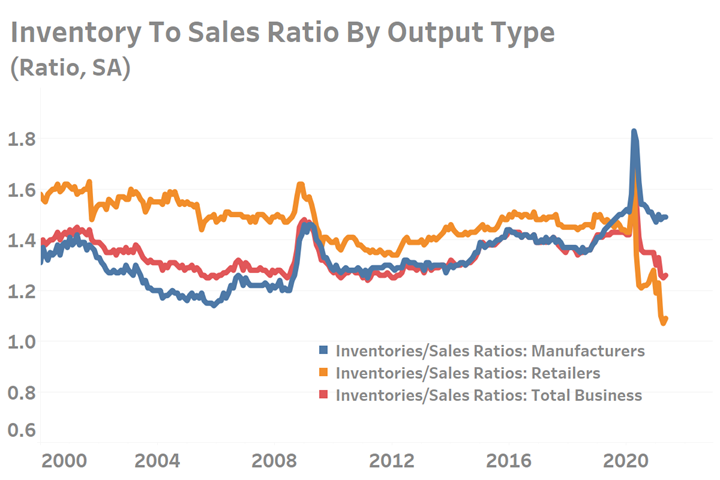

However, as the services side of the economy re-emerges from lockdown, transportation networks will have to manage overwhelming demand from retailers desperate to fill their store shelves once again. This will pit manufacturers and retailers against one another for limited over the road “OTR” shipping capacity. The latest data released by the American Trucking Associations (ATA) indicates that inventory-to-sales ratios remain incredibly low for the retail sector. As this side of the economy seeks to rebuild inventories, it will strain all forms of transportation, especially that of OTR capacity. Based on the latest inventory-to-sales ratio data for manufacturers, retailers and total business, it is understandable that supply chain experts are concerned that things this year will get worse before they get better.

Based on a typical seasonal retail planning timeline, retailers should have placed their Thanksgiving inventory orders in June and should be ordering their holiday and end-of-year orders now in July. Given the strong financial position of consumers and the desire by retailers to return to profitability, it would seem reasonable to expect that they are making substantial orders to refill deeply depleted inventories. The result of such logic almost certainly suggests that transportation capacity will be a highly valuable and fought over resource through at least the rest of the calendar year, adding to the headaches of manufacturers for quite a while longer.

.jpg;width=70;height=70;mode=crop)