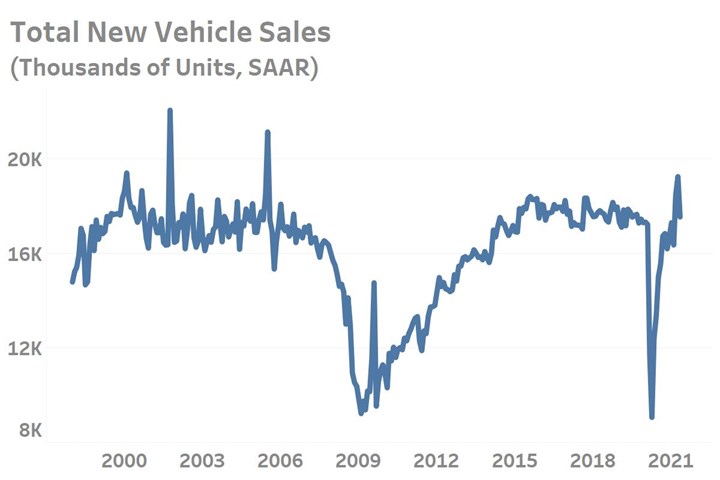

Total Vehicle Sales Volumes Press Higher Despite Rising Prices

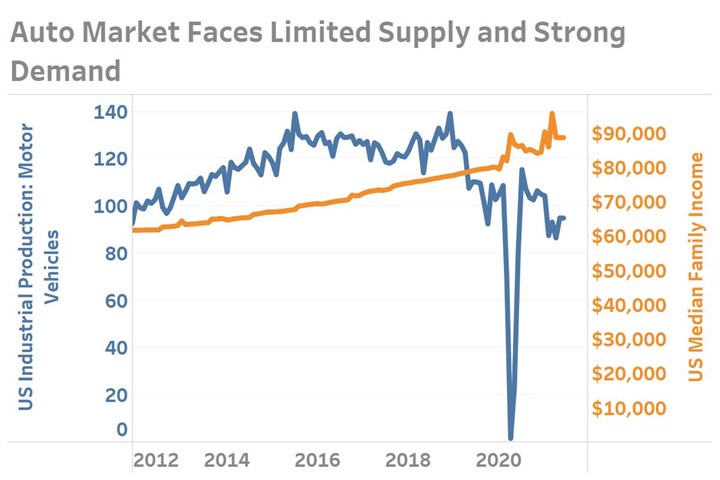

Automotive industry news during the second quarter of the year was highly concentrated around the financials of the big automakers and the improved profits they generated thanks to strong pricing despite supply chain challenges which suppressed production levels at many factories in the United States and around the world. For this reason less attention was given to monthly volumes (at seasonally adjusted annual rates, SAAR). Production constraints aside, second quarter sales volumes were impressive, led by April’s 19.2 million units reading which then gave way to a May reading of 17.5 million.

Automotive industry news during the second quarter of the year was highly concentrated around the financials of the big automakers and the improved profits they generated thanks to strong pricing despite supply chain challenges which suppressed production levels at many factories in the United States and around the world. For this reason less attention was given to monthly volumes (at seasonally adjusted annual rates, SAAR). Production constraints aside, second quarter sales volumes were impressive, led by April’s 19.2 million units reading which then gave way to a May reading of 17.5 million.

Source: U.S. Bureau of Economic Analysis

Compared to past peaks, May’s reading was the highest since July of 2005 and before that October of 2001. However, those historic highs came thanks to deep price discounts. The 2005 reading came as a result of GM providing for the first time ever employee discount pricing to regular customers which was then quickly followed by other manufacturers. Similarly, the October 2001 all-time record volume reading came thanks to deep price cuts by manufacturers who anticipated a challenging economy ahead.

No such pricing discounts aided May’s vehicle unit sales. Rather, rising volumes in 2021 have come in tandem with rising prices. According to Kelley Blue Book and as reported by prnewswire.com, the average price for a new “light vehicle” was nearly $41,000 in April. Compared to pre-pandemic prices, new vehicle in the second quarter of the year were up over 5.5%.

Source: Median Income provided by the Census Bureau, Industrial Production data provided by the Federal Reserve.

The recently swelling in both price and volumes in the immediately after April was not too surprising; however, it does suggests that there is far more pent-up demand for vehicles than the data are leading onto. Strong demand, high levels of savings, low interest rates and historically high levels of disposable income will all continue to create strong demand for new vehicles for the foreseeable future.

.jpg;width=70;height=70;mode=crop)