Supply Chains Making Modest Progress Returning to "Normal"

Supply chain readings during the fourth quarter of 2021 declined from both their 2021 and all-time highs. For manufacturers this will be welcomed news.

While still incredibly high, supply chain readings are finally and decisively moving in the right direction. This should be welcomed news for any manufacturer who is struggling to raise production levels and or better control backlog levels.

The Gardner’s Business Index (GBI), tracks six business activity components across several major manufacturing disciplines from metalworking to plastics, moldmaking and finishing among others. Of those six business activities [new orders, export orders, production, backlogs, supplier deliveries, and employment], tracking and reporting the status of supplier delivery activity has been of particular importance since COVID impacted the world in early 2020.

A Brief History of Recent Supplier Delivery Readings

Throughout the last three quarters of 2021 supplier delivery readings averaged over 80.4. To put this in perspective, the pre-pandemic all-time 1-month high reading was 63.3. In order to reach a low 80’s figure requires that at least 65%, but more likely nearer 80%, of Gardner’s many hundreds of surveyed respondents told us that a given month’s supply chain performance was worse than the prior month’s. That such a high proportion of respondents to report worsening conditions for 9 consecutive months is beyond unprecedented.

Progress Is Coming, But We Aren’t Anywhere Near Home Yet

Mercifully, 4Q2021 readings trended lower, ending with a December reading in the mid-70’s. While still extreme by historic means, this lower figure is comparable to readings from the start of 2021 and well off recent climatic readings. In short, a growing proportion of manufacturers are stating that supply chain performance is either consistent from month to month or even improving. However, this proportion, while growing, is still deeply in the minority.

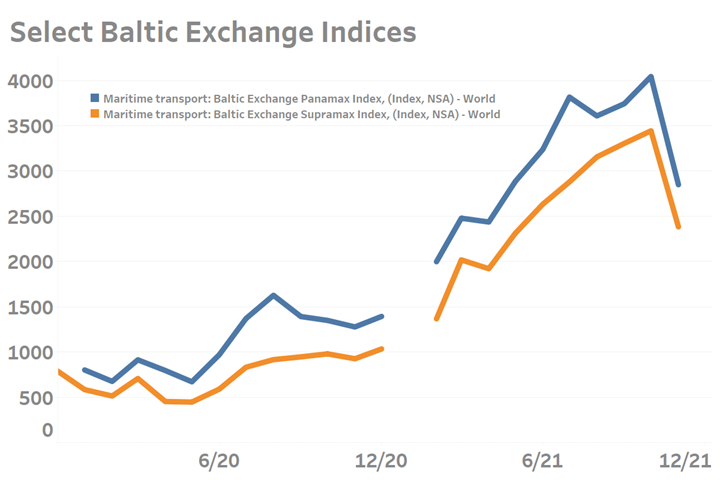

Other signs are also indirectly pointing to a modest alleviation of supply chain problems; in particular, ocean freight container pricing has come well off its October highs. Between late-October and late-December the Baltic Exchange Panamax Index as calculated by Moodys Analytics had fallen by 42%. While clearly off its peak, the latest reading is still 3-times higher than those reported in the months just prior to the pandemic.

Index values calculated by Moodys Analytics

.jpg;width=70;height=70;mode=crop)