Supply Chains Greatly Restrain Production Levels While Revenues Are Less Affected

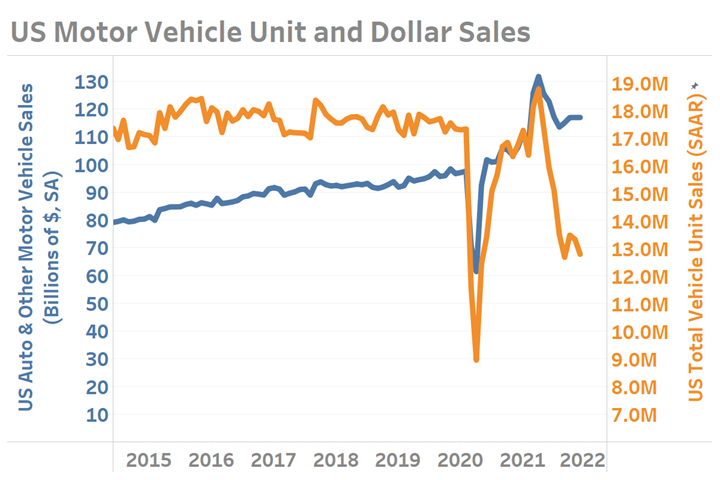

December’s U.S. motor vehicle sales fell below 13 million units for only the second time since June 2020.

Auto industry figures reported throughout the second half of 2021 highlight the industry’s ongoing struggles. U.S. total unit vehicle sales in both September and December dropped below 13-million units. The last time the industry experienced similar results was in June of 2020, only a few short months after the Government declared COVID-19 a global pandemic and quickly shut down large segments of the economy.

For those who have read Gardner Intelligence’s Capital Spending report, you will know that our 2022 projection was more distressing than some of our peers, with a double-digit contraction expected although we left open the possibility of upward revision. Much of this projection had to do with 2022 expectations of the automotive industry followed secondly by the aviation market.

Unit sales figures provided by the U.S. Bureau of Economic Analysis, monthly dollar sales figures provided by the U.S. Census Bureau. Visualizations of data series ending December 2020.

As our projections relate to the automotive industry, both the latest 2021 unit sales and production figures for the industry focalize the magnitude of our projection. Since reaching a localized peak of 18.8M unit sales on a seasonally adjusted annual rate (SAAR) in April of 2021, total vehicle sales fell sharply in each of the following months until reaching a September low of 12.7M units. The last three months of 2021 were not significantly better, with average vehicle sales at just under 13.1 million units SAAR; a figure that pales in comparison to the pre-pandemic average sales of 17.6 million units SAAR between January 2016 and January 2020.

On a unit basis, this represents a full 25-percent decline in vehicle sales volumes; however, from the financial perspective of the OEMs, strong consumer demand thanks to various government schemes and a strong jobs market has resulted in a far smaller revenue impact. Monthly revenues in the fourth quarter of 2021 averaged $116 billion, more than 16-percent above the average comparable sales figures recorded during the fourth quarter of 2019.

Should the industry remain on the path towards pre-pandemic business conditions, we expect production to slowly but significantly improve while unit pricing and per-unit profitability return to more traditional levels. Although this will likely reduce unit profitability in some parts of the industry, elevated production levels will bolster overall machine tool unit consumption and ultimately help the industry to heal from COVID’s impacts.

.jpg;width=70;height=70;mode=crop)