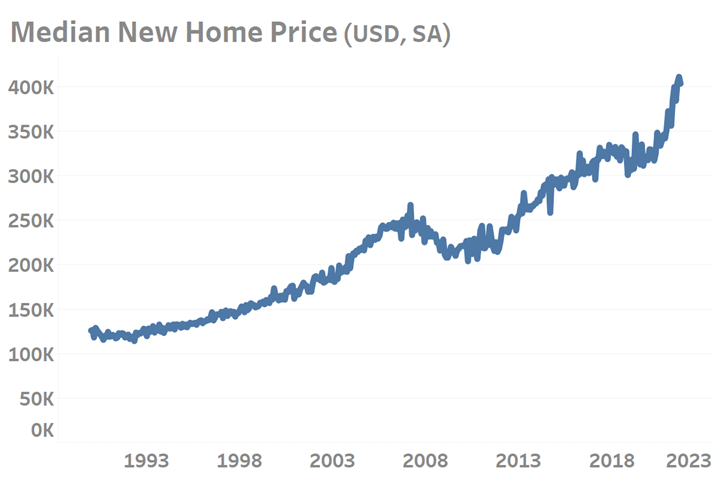

Median Home Prices Up 27-Percent In 15-Months

The appreciation of home prices in the 5-quarter period ending September 2021 may be the fastest in recorded history going back to 1963.

Data released through the end of the third quarter of 2021 (3Q2021) by the Federal Reserve Economic Data “FRED” platform reported one of the fastest 12-month periods of home price appreciation in decades with September’s median home sales price exceeding $403,000. The latest reading represents a nearly 19% increase in home prices compared to the same month a year ago. However the latest 12-month change is slightly below the comparable August gain of 23.2%. Transitioning to quarterly data, home prices in 3Q2021 rose by 15.3% when compared to their inflation-adjusted median price from 3Q2020.

Of concern is that the price gains achieved since the start of the COVID pandemic exceed comparable gains measured during the months and years leading up to the Great Recession of 2007 through 2009. In the run-up to the Great Recession, annual median home price appreciation peaked at 12.6% during 1Q2004.

Median home prices have risen at well above the rate of inflation in recent years. Data provided by the U.S. Federal Reserve Bank.

To argue that this is a fair comparison would be short-sighted. Consumers have substantially changed their domicile preferences since the start of the pandemic with many people leaving densely populated city centers and moving into single-family homes. The transition to remote work means that new home owners are more likely to be looking for homes that will not only accommodate the typical needs of a family but also the needs of the at-home worker which may include a home office. As people spend more time at home and less time outside this may incentivize buyers to buy larger homes with more amenities such as pools, in-home theaters or elaborate kitchens than they would have previously. To quantify this preference for larger homes consider that the median home size in 2020 was 2,333 square feet, up from 2,057 in 2000 according to Statista; representing a 13% increase in the median home size over a 20-years. The difference between the median and average home size in recent years —with the average being significantly greater— implies however that the growth of very large homes is significantly contributing to the overall booming housing market.

As nations continue to lock-down economies and restrict the freedom of movement out of fear over the pandemic, there is little to suggest that consumer preferences for single-family homes will abate. Only the continued rise in prices and the nearly certain rise in future mortgage interest-rates will curb home demand as more potential buyers are priced out of the market, or lack the free cash flow to afford current principles at higher rate loans. It is for this reason that Gardner Intelligence continues to advise its manufacturing clients to monitor financial conditions —and especially rising interest rates— for signs of a potential market slowdown.