Is the Housing Market Starting to Cool?

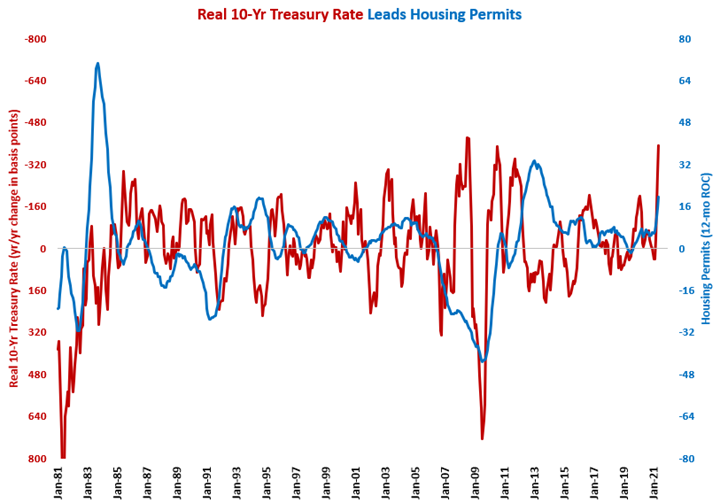

Compared with the last two months, housing permits were down about 10% in May. However, the year-over-year change in the real 10-year Treasury rate went down significantly, which is normally a positive sign for growth in housing permits.

There were 142,300 housing permits filed in May 2021, which was 36.3% more than the number of permits filed one year ago. The rate of growth was helped by an easy comparison with May 2020. Housing permits grew 11 of the last 12 months, and in 10 of those months, the growth was faster than 11.5%. However, the number of permits filed in May was about 10% less than the number of permits filed each of the last two months.

Regarding the annual rate of change, May was the 21st straight month of growth and the 14th in the last 16 with growth faster than 5.0%. The annual rate of growth accelerated to 19.6%, which was its fastest rate of growth since November 2013.

While the nominal 10-year Treasury rate was unchanged in April, the real 10-year Treasury rate fell to its lowest rate since June 1980. The reason for this was that the rate of inflation increased to 4.99% in May, which was the highest rate of inflation since August 2008. As the real 10-year Treasury rate is the nominal rate minus the inflation rate, the real 10-year Treasury rate was -3.37% in May. This is very stimulative to the economy.

The year-over-year change in the real 10-year Treasury, now -392 basis points, was more negative for the third month in a row. The change was negative for 20 of the last 22 months, falling to its lowest level since August 2008.

The change in the 10-year Treasury rate is a good leading indicator of housing permits and construction spending. A decreasing year-over-year change in the real 10-year Treasury rate typically leads to increases in housing permits.

.JPG;width=70;height=70;mode=crop)