Is All This Money Really a Good Thing?

Many people talk about there being too much money in the financial system, yet justifying this argument can be difficult.

Many people talk about there being too much money in the financial system, yet justifying this argument can be difficult. If there was ever a time for this discussion that time is now. During the first 18-months of the COVID pandemic, stimulus spending alone amounted to $3.5 trillion according to the government’s own admission(https://www.usaspending.gov/disaster/covid-19). This was only a part of the government’s total 2020 spending of $6.55T, of which only $3.42T was supported in collections. This does not include current fiscal year deficit spending nor any future stimulus or infrastructure bills yet to be passed. Financing this spending requires others to purchase Treasury debt (“Treasury securities”) and this is where the Federal Reserve has been essential in each of the last two recessions (2007, 2020). Between March 2020 and the latest available figures through July 2021, the Federal Reserve added nearly $3.0 trillion of Treasury securities to its balance sheet. While this did not exclusively finance the government’s COVID relief programs, these figures do make clear that the government’s ability to spend borrowed money is highly dependent upon the Federal Reserve.

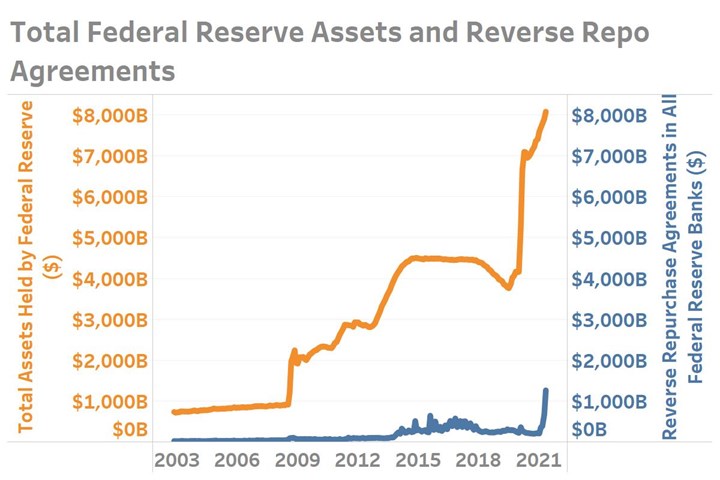

The Federal Reserve has increased its total assets by several trillion dollars in the last 18 months largely by purchasing government debt which was used in part to pay for several rounds of economic stimulus packages. Recently, a trillion more dollars than usual is ending up back at the Fed.

Yet for all the new money generated and spent by the government, the equivalent of a quarter of that newly created money has recently been spending its nights back at the Federal Reserve in what is known as a Reverse Repurchase Agreement. This is where the “traditional” banks we know, among others, park their excess money to earn a pittance in interest income rather than none at all by letting it sit in their own vault. That the number has jumped six-fold from around $200 billion just prior to the pandemic to $1.2T in July 2021— or roughly a third of total stimulus spending— should be a concern. It implies that the owners of that money “capital” don’t have a good strategic plan for it despite historically low interest rates and rising inflation costs. Furthermore, this is happening while the Federal Reserve is still pumping an additional $120 billion every month into the economy and lowered bank reserve requirements (https://www.federalreserve.gov/monetarypolicy/reservereq.htm).

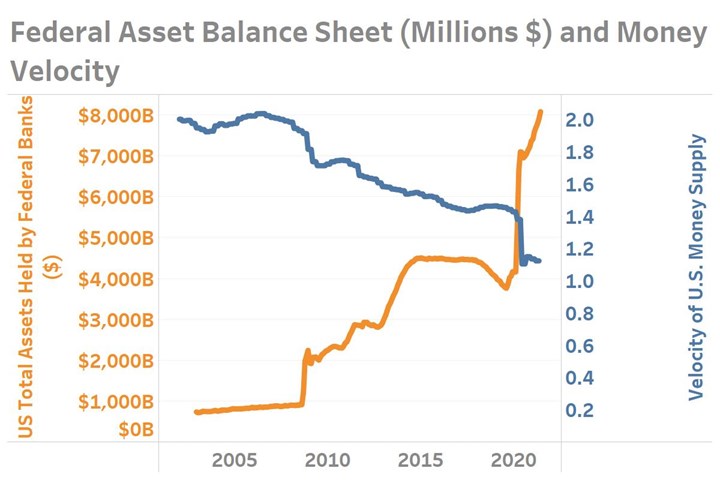

As more dollars are put into the economy without a proportionate increase in economic activity, the number of times that dollar is used - its “velocity”- is decreased. For decades this number averaged about 1.8 for the 40-year period ending in the early 1990s and over 2.0 in the 1990s and early 2000s.

That this capital has limited use is further apparent by today’s historically low turnover rate “velocity” of money. At a current reading of 1.12, this is the slowest reading of money velocity in the last 70 years of recorded history. While it is not unusual for people to want to hold more cash during an economic shock as a way to bolster their own “safety net,” such savings as illustrated by data from the Great Recession of 2007-2009 lowered velocity, but kept it within historical norms. In contrast, there now appears to be an overwhelming flood of dollars which don’t appear to have a thoughtful purpose. This should be a concern to anyone worried about if the government is creating ideal conditions for a future of rising inflation and excessive government debt burdens.

The Federal Reserve’s goal of walking that fine line between supporting economic growth and preventing inflation is likely to become all the harder given the nation’s current monetary and fiscal position. The odds of a future containing stronger price inflation should be on the minds of all business leaders and their pricing and cost control strategies not only now, but well into 2022 and even beyond.

.jpg;width=70;height=70;mode=crop)