How Are Wages are BOTH Up and Down At the Same Time

Rising prices within supply chains has already created cost control problems for manufacturers; unfortunately, there is an even more concerning “dark cloud” coming as workers see paychecks rise while their standard of living decreases. This could lead to additional rounds of wage increases.

U.S. Inflation reached 6.8% in November based on data from the Consumer Price Index (CPI), the highest it has been in nearly 40-years. This latest bout of inflation has been relatively rapid with inflation rising 6.7% over just the last 18-months. The last time that inflation rose so fast and so quickly the Korean War had only just started; even the inflation shocks of the 1970’s and early 1980’s took longer to achieve a 7% increase in inflation rates.

An evaluation of time-series data virtually assures us that the rapid increase in inflation has been driven by the incredible expansion of the money supply by the Federal Reserve starting in February of 2020. Between January 2020 and October 2021 the Federal Reserve increased the money supply by almost 37%*. Some reasons for the deficit spending may be considered noble, such as to support the research and development —and later distribution— of a COVID vaccine, there were, however, a myriad of other programs that heightened demand for goods at a time when suppliers were least capable of meeting this heightened demand.

As readers of Gardner Business Media’s many manufacturing centric brands, I know that readers of such content don’t need anyone telling them about labor and materials shortages and challenging production conditions. The problem is that while inflated supplier prices have been top-of-mind in 2021 for many manufacturers, 2022 could very easily be the year of the most significant wage increases in decades!

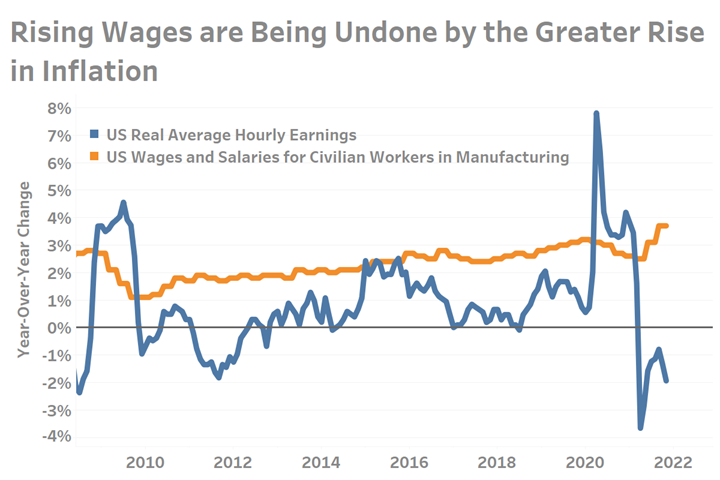

Despite rising headline wages, quickly rising prices since 2020 has actually resulted in many people experiencing a reduced standard of living.

The year-over-year change in U.S. wages and salaries for civilian workers in manufacturing reached 4% in November, marking the fastest rate of growth in the last 20-years. Unfortunately, an even faster rise in the rate of inflation means that laborers began experiencing a falling standard of living in the second half of 2021. During the months between April and November 2021, real average hourly earnings declined by an average of -1.9% entirely because inflation is outstripping even the exceptional recent rise in wages. If inflation continues at its latest pace of 7% throughout 2022 workers will need a 7% increase in wages a year from now just to maintain the same standard of living they have now.

Therefore, the only way that employees will be able to maintain their current standard of living will be to go back to their employer and ask for yet further wage increases. Of course doing this will result in manufacturing costs rising even higher which will then force the prices of goods higher still to offset rising wage expenses. This self-perpetuating cycle of rising costs and prices is why traditional economic thinking about inflation is so concerning and why the Federal Reserve in the 1980’s had to act decisively to quell inflation.

* As measured by the M2 the money supply grew by 36.9%. In its broader measure called M3, the money supply has increased by 36.2%

.png;maxWidth=728;quality=90)

.jpg;width=70;height=70;mode=crop)