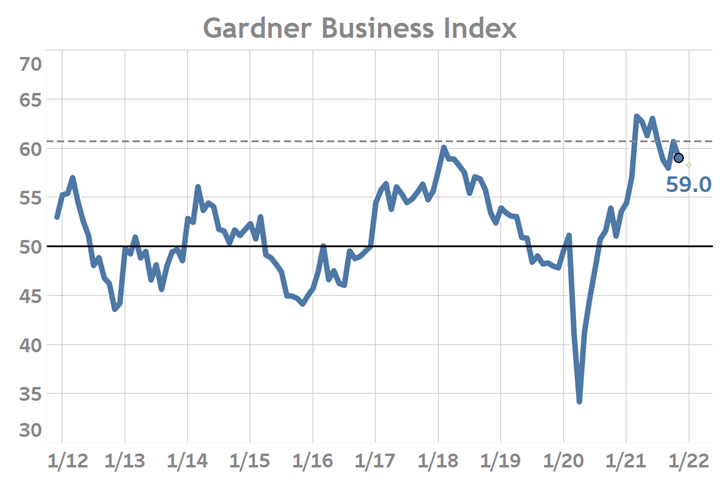

Gardner Business Index - November 2021: 59.0

Business Activity Expansion Slows Across Most Metrics The Gardner Business Index (GBI) reported slowing expansion during November with a closing reading of 59.0.

Business Activity Expansion Slows Across Most Metrics

The Gardner Business Index (GBI) reported slowing expansion during November with a closing reading of 59.0. Among the six components which constitute the Index, November’s results pointed to a narrowing spread between new orders and production activity as the expansion in new orders decelerated relatively quicker. This narrowing spread contributed to the 5-point decline in backlog activity for the month. The reading for employment activity fell only slightly but remains near its 2-year high and in-line with elevated readings since March 2021. Supply chain performance remained challenging in November with only a small decline from the prior month’s reading. November marks the eighth consecutive month in which supply chain readings have remained near ‘80’, indicating that most manufacturers continue to experience painful supply chain problems with no relief in sight. For the third time this year export activity registered above ‘50’, signaling a modest expansion export orders compared to October.

The GBI closed November down nearly 2-points from the prior month.

Having now faced nearly a year of unprecedented supply chain challenges, production activity in more recent months has acutely felt the pain of this disruption. This has been exemplified by the accelerating decline in production activity readings in the second half of the year. The latest 3-month average reading at 55.2 is only slightly above the production series’ historical average reading of 53.6. This contrasts sharply with 1Q2021 readings which registered expanding production levels at near all-time highs.

Supply chain problems continue to manifest themselves elsewhere in Gardner’s data. The proportion of respondents reporting rising month-to-month material prices from their suppliers remains well above historic norms with as many as 9-in-10 reporting rising monthly costs between April and November. This compares unfavorably with the smaller yet growing proportion reporting the ability to pass higher prices onto their customers. Given that such conditions can severely pressure operating margins, it is little surprise that business optimism has declined since the early months of the year.

.jpg;width=70;height=70;mode=crop)