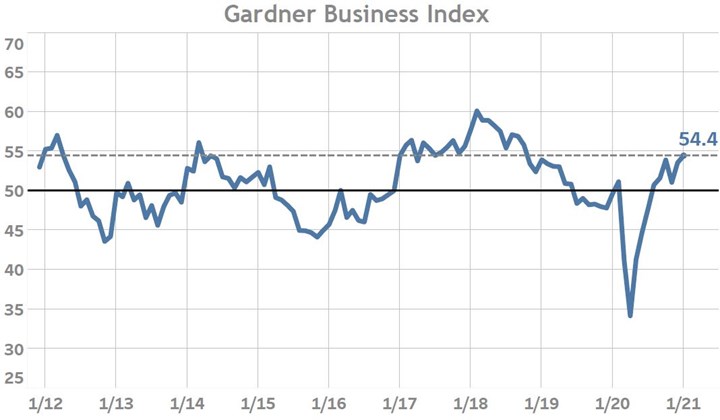

Gardner Business Index for January 2021: 54.4

The Gardner Business Index (GBI) increased during January thanks to expansionary readings in five of the Index’s six components. The move higher was led principally by supplier deliveries, production and new orders readings.

Manufacturing Reports a Strong Start to 2021

The Gardner Business Index (GBI) moved higher in the first month of the new year, continuing along the expansionary trajectory set during the final quarter of 2020. January 2021’s reading of 54.4 marks the highest reading since the fourth quarter of 2018 when the Index was coming off its longest expansion since at least 2011. All six of the components which constitute the Index again moved higher in absolute terms during the month with production and new orders each reporting their sixth consecutive month of expansionary activity. The uncomfortably high readings for supplier deliveries continue to stymie the desired level of production as evidenced by the accelerating expansion in backlog activity. In contrast, Gardner’s measure of export activity contracted for another month; however, this is consistent with the broader economy’s decline in goods exports of 6.7% according to the latest federal government data[1].

Now that the seasonal surge in shipping demand is generally behind us -less those making holiday returns- January’s exceptionally high supplier delivery readings was disappointing. The latest reading makes understanding its cause even more important for manufacturers if it cannot be explained by the influence of seasonal retail sales. Although historical GBI supplier delivery data does not suggest there is seasonality in the order-to-delivery times of manufactured goods, the last 12-months have seen seismic growth in the long-run trend of growing e-commerce sales. If COVID permanently accelerates this trend moving forward, it could result in the development of a cyclical trend in slowing supplier delivery activity in the months leading up to the winter holidays.

January’s material prices and prices received data was also closely watched by the Gardner team. January’s reading of material prices -a proxy for production costs- rose over 4-points, closing in on the all-time high set in 2018. The latest rise may have been the result of suppliers implementing new pricing for 2021 combined with their heighted pricing power due to snarled supply chains worldwide. Simultaneous with this change was a significant but smaller increase in the prices received index which monitors the pricing power of manufacturers. Here too the data reported a rise in January, but well less than that evidenced by material prices. Their net-effect suggests that manufacturing profit margins are still under pressure from overwhelming cost increases.

Gardner Business Index: January 2021

The Gardner Business Index opened 2021 with a 2-year high reading.

Supplier Chain Woes Persisting into 2021

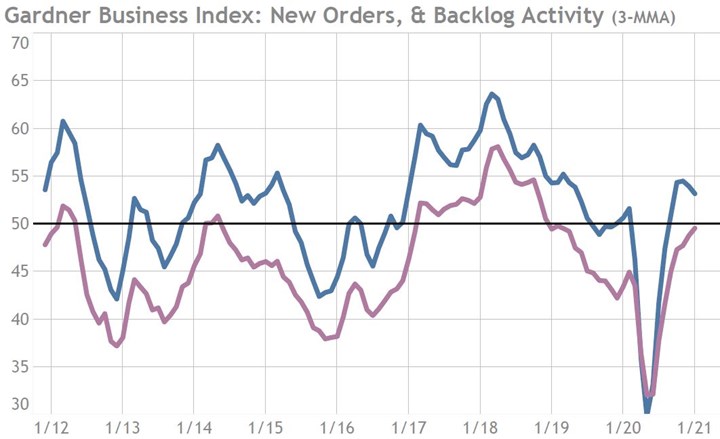

Backlog activity continued its acceleration through January, setting a 2-year high reading. It is believed that this expansion is the result of strong domestic new orders and severely disrupted supply chains.

Expanding new orders activity and slow supply chains have prompted backlogs to expand for the first time in approximately 2-years.

Gardner Intelligence does its utmost to provide regular and informative updates on the state of manufacturing. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to tell us how your businesses are faring. Only through your participation are we able to assess the current state of the industry and where it may be heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn as well as our YouTube Channel.

[1] US Exports of Goods is reported by the US International Trade Commission whose latest reading reflects November’s data.

.jpg;width=70;height=70;mode=crop)