Cutting Tool Orders Sluggish in January

It is likely that the January orders were affected by shift and/or plant shut downs in the automotive industry due to a lack of computer chips. Also, it should be expected that February order totals will be somewhat sluggish for the same reason in addition to the deep freeze from Texas through much of the Midwest.

In January 2021, real cutting tool orders were $152.2 million, contracting 23.0% from January 2020. This was the second-fastest rate of contraction since August 2020. It is likely that the January orders were affected by shift and/or plant shut downs in the automotive industry due to a lack of computer chips. Also, it should be expected that February order totals will be somewhat sluggish for the same reason in addition to the deep freeze from Texas through much of the Midwest. January was the 23rd consecutive month of month-over-month contraction, but these same figures clearly show that the contraction is slowing. Further, starting in April, the month-over-month comparisons get much easier.

The annual rate of change contracted at an accelerating rate for the 16th month. The annual rate of contraction was 23.8%, which was the fastest rate of annual contraction since the data was made public. The annual rate of contraction will likely accelerate a little through the March data release. Near the end of the first quarter, the annual rate of contraction should begin decelerating.

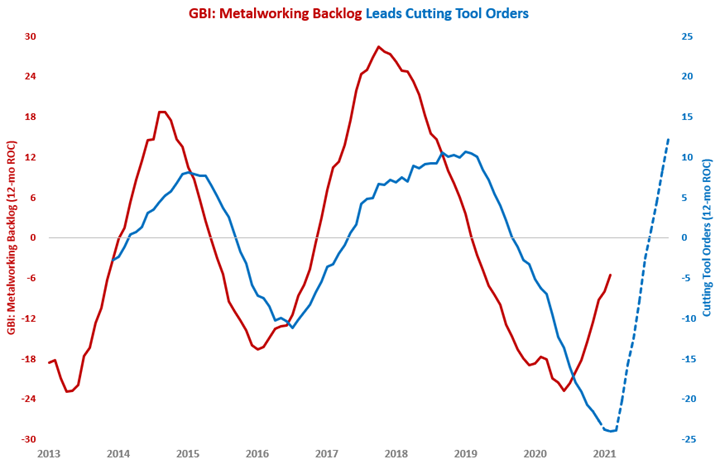

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. In February, the index was above 50 for the fifth month in a row and the month-over-month rate of change in the index grew for the seventh consecutive month and February’s rate of growth was the fastest since December 2017. The annual rate of contraction decelerated for the eighth straight month, indicating that the annual rate of contraction in cutting tool orders should bottom in the first quarter of 2021.

In the chart below, the dotted blue line represents the possible recovery in cutting tool orders. The forecast calls for cutting tool orders to grow by 12.2% in 2021 compared with 2020. The rate of recovery is faster (or steeper) than the previous two growth cycles for cutting tool orders because of the comparison in 2021 to periods of economic lockdown in 2020. This projection is relatively modest when compared with actual levels of historic cutting tool orders. One reason for this is that supply chain disruption may slow the manufacturing recovery.

.JPG;width=70;height=70;mode=crop)