As Inflation Becomes A Growing Concern What Measures Should Manufacturers Be Watching?

Many experts have been debating whether the current surge in inflation will be temporal or more permanent. When one moves from the theoretical realm to the reality of supply chains the picture becomes more concerning.

Many experts have been debating whether the current surge in inflation will be temporal or more permanent. When one moves from the theoretical realm to the reality of supply chains the picture becomes more concerning. Regardless of how accurate any individual or team’s inflation predictions end up being six-months or a year from now, there are free data resources that we will share with manufacturing leaders in this article which you can use to monitor pricing conditions from your own office desk.

Inflation concerns have been all the talk recently in business and economic circles. Some claim that high inflation will be only temporary and that in the longer run it will move lower and therefore need not be overly concerning. Others believe that we may have already unlocked “Pandora’s box” and that consumers and businesses are presently ̶ or already have ̶ shifting their expectations about inflation over the next few years. The issue is further obscured when distractive disagreements arise over how one calculates inflation and which calculation is more ‘right’ than another.

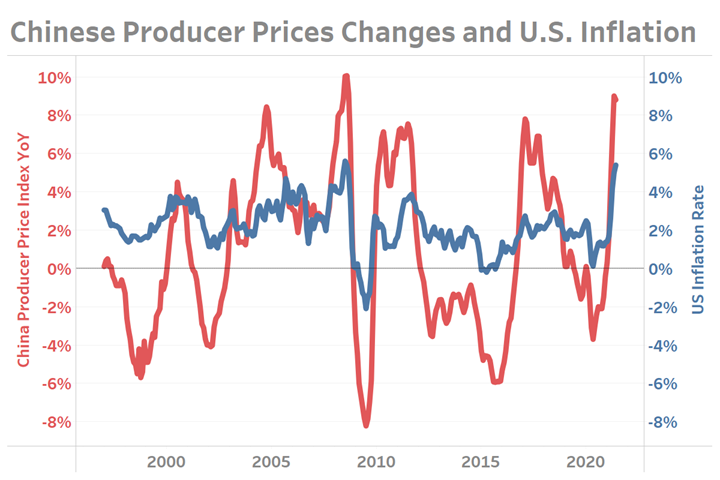

There are many forces at work presently that are pushing prices higher in the eyes of the end consumer and which manufacturers have been made all too aware of over the last 18 months. Moving up the supply chain, Chinese Producer Prices reported less than 1% inflation at the start of 2021, but then quickly surged. By June, the index had recorded a 9% increase in producer prices over the last 12 months. Similarly, the China Producer Prices Index: Means of Production Index registered 112.0 in May and 111.8 in June; both readings were higher than any time over at least the last 24 years. The swelling of production costs and input prices up the supply chain will continue to make their way down into finished goods.

Sources: National Bureau of Statistics of China, U.S. Bureau of Labor Statistics https://data.bls.gov/cgi-bin/surveymost

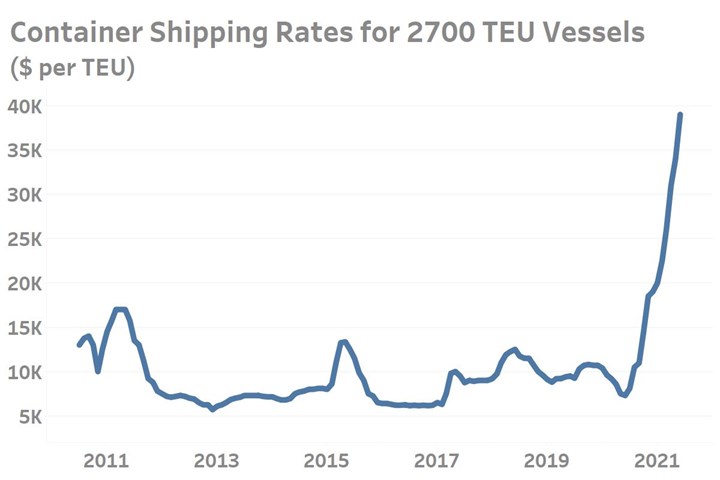

Transportation costs continue to put indirect upward pressure on downstream goods as well. Pre-pandemic transport prices ̶ as opposed to their temporary lows during COVID̶ are up +400% for ocean containers and over 200% according to the Baltic Exchange Airfreight Index. Transportation bottlenecks continue to haunt the industry and raise the costs ̶ and thus prices̶ for all goods and in particular those requiring international transit.

Source: Harper Petersen & Co.

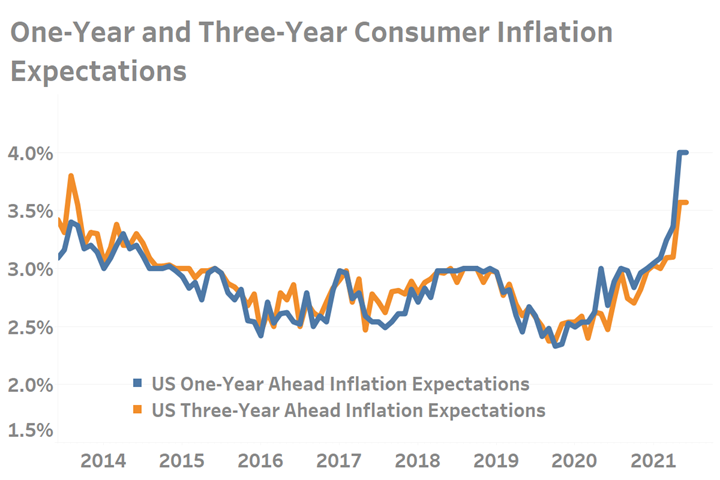

Whether or not recent inflation rises become part of a permanent change in the economy will largely be decided by consumers and businesses making pricing decisions. The longer that demand continues to remain extremely robust and supply chains continue to struggle to normalize, the greater the risk that consumers and companies will begin to simply factor in rising prices and wages into their long run inflation expectations. If this should happen, the probability that current inflation thinking moves from being a temporal event to a more permanent becomes all the greater.

Source: Federal Reserve Bank of New York https://www.newyorkfed.org/microeconomics/sce#/inflexp-3

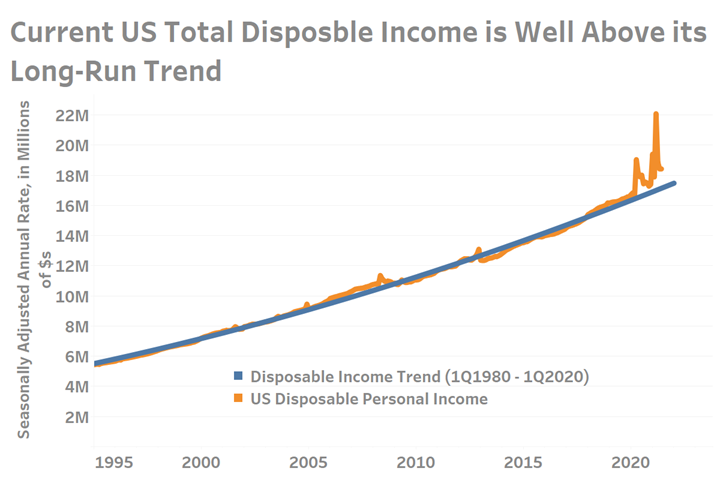

The question of whether consumers can keep up this pace of spending is hardly a question of “if”. U.S. disposable income remains significantly above its long-run growth rate at $18.4 trillion. This surge in disposable income has largely been directed toward savings that could support strong consumption levels, even in the face of rising prices. According to the Bureau of Economic Analysis, the personal savings rate in 1Q2021 registered 21.5%, the latest period for which data are available. When converted to annualized dollars, this represents a total of $4.6 trillion of money being saved for future use and is at least $2 trillion above historic norms. By both measures, savings activity has increased by 300% compared to pre-pandemic levels. The rise in disposable income has lowered debt service as a percentage of disposable income to 9.4%. Applying current debt servicing to the long-run trend in disposable income results in a debt service rate that is just below 10%.

Trend calculation from Gardner Intelligence, original US Disposable Personal Income from: https://fred.stlouisfed.org/series/DSPIC96

Recent months of loan officer survey data also show a rapid decline in the level of banks tightening loan standards for businesses. This will certainly keep the “pedal to the metal” as firms take advantage of low interest rates during a time of significant economic growth for the overall economy. The extra return that investors demand to hold more risky corporate debt over treasuries, which are considered “risk free”, approached all-time lows in early July. This marks a historic opportunity for firms to borrow at rock-bottom rates.Within the manufacturing sector specifically, the spread between credit extended and new credit applications ̶which collapsed during the worse of the pandemic in 2020 ̶ had normalized as recently as May. The amount of credit extended is now well above the amount of new credit applied for, which is in keeping with historic norms.

The overall level of financial resources available to both consumers and firms at present combined with restrained supplies has created and continues to support an economic environment which will continue to pressure prices for quarters to come. The majority of economic experts appear to express hope that recent price increases are temporal; however, when one considers the time duration of manufacturing supply chains and the near-certainty of loose monetary and fiscal policy through at least 2022, it becomes more difficult to believe that consumers and companies will accept a further 18-months of potentially rising prices without adjusting their long-run price and wage expectations. Once this happens, the possibility of being on a self-sustaining inflationary path without some kind of intervention becomes very real.

.jpg;width=70;height=70;mode=crop)