Americans Need to Re-Engage in the Workforce If the Economy Is to Recover

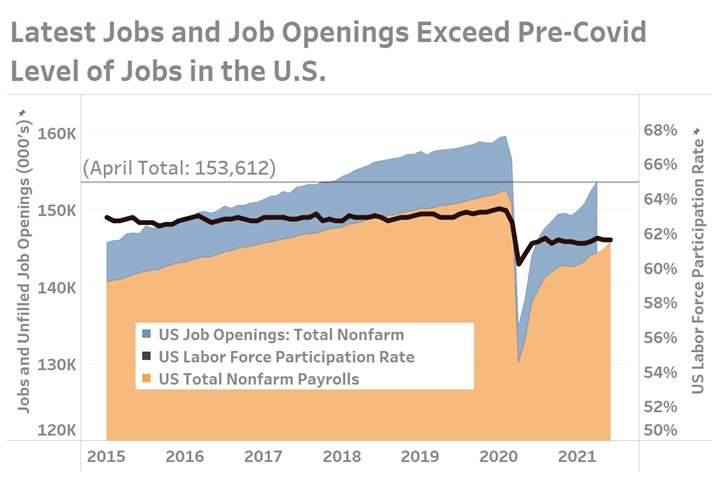

Struggling supply chains explain only part of the story behind the inability of industry to keep up with the demand for goods and services and the consequential rise in prices. As America was putting the worse of COVID behind it during the first half of 2021, a large proportion of the workforce failed to return. Just prior to the pandemic, the labor force participation rate was just over 63%. That rate then fell to 60% with the forced closure of large portions of the select industries, but then quickly rebounded to 61.7% by September 2020. In the 9 months that followed, the labor participation rate would remain virtually unchanged.

Struggling supply chains explain only part of the story behind the inability of industry to keep up with the demand for goods and services and the consequential rise in prices. As America was putting the worse of COVID behind it during the first half of 2021, a large proportion of the workforce failed to return. Just prior to the pandemic, the labor force participation rate was just over 63%. That rate then fell to 60% with the forced closure of large portions of the select industries, but then quickly rebounded to 61.7% by September 2020. In the 9 months that followed, the labor participation rate would remain virtually unchanged.

At the nadir of the pandemic in April 2020, payroll counts had fallen by 23 million, or nearly 15% from just two months prior. It would not be until that coming September that half of those losses —approximately 11 million jobs — would be recovered in some way. Unfortunately, the rate of recovery has since slowed dramatically. Between September 2020 and June 2021, payrolls increased by another 3.9 million for a total count of 145.8 million. The remaining gap of 6.8 million lost payrolls since the start of the pandemic suggest there is still much potential economic activity yet to be unlocked.

April unfilled job openings data — the latest available as of the time of this article’s publication — stood at a multi-decade high of nearly 9.3 million, or 2 million more openings than just before the pandemic. The sum of April 2021 total payrolls and unfilled openings at 153.6 million was in fact greater than total pre-pandemic payrolls, although not greater than pre-pandemic openings and payrolls. The combination of June 2021 payrolls and April unfilled openings would total over 155 million, quickly closing in on the 159 million jobs and openings reported in February 2020.

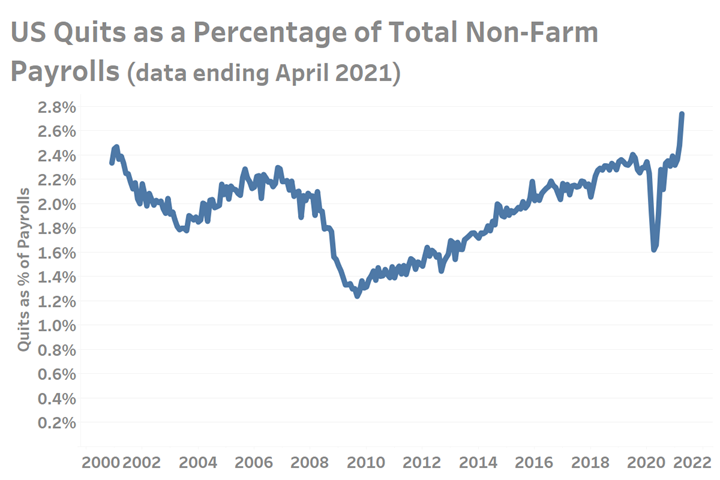

Despite an outstanding payrolls gap of 7 million since the pandemic, the decision by employees to leave their jobs as of April 2021 had never been higher since at least the early 2000s. During the last three economic cycles, employees quit their jobs around the peak of an economic expansion. In none of these instances, however, did quits as a percentage of payrolls exceed 2.5%. That historical limit was broken with April’s data reporting 3.9 million quits, or 2.7% of total payrolls.

In summary, the combination of a historically low labor participation rate and historically high quits rate at a time when companies (especially those that are part of a supply chain) are sorely in need of labor is adding to the present imbalance of supply and demand which is only being equalized through rising prices. A healthier, more durable and sustainable path to a full recovery is only possible if more people come back into the workforce.

.jpg;width=70;height=70;mode=crop)