2021 Will (Again) Be the Year of the Supply Chain

The work of reinforcing and evolving manufacturing supply chains still has a long way to go in 2021. Firms which simply get their supply chain back to where it was pre-COVID will be exposed to inflating costs and the risk of lost sales opportunities.

In mid-February 2021, Gardner Intelligence had the privilege of speaking to the AMT on the state of supply chains and their importance in 2021. Our message in short was that like the second-half of 2020, 2021 will be the year of the supply chain. Yet the reasons behind why 2021 will be the year of the supply chain have evolved. In 2020, the goal for many firms was to reorient themselves after COVID’s abrupt and severe impact on supply chains in order to have at least a minimally functional supply chain that could maintain modest production targets. Data from the Gardner Business Index (GBI) during 2020 made it quite apparent that inventory management was a significant problem for many firms as global shutdowns resulted in severely delayed and/or non-deliveries from suppliers. The closure of plants and production slowdowns of critical goods resulted in many downstream firms having to stop production for lack of one or several sub-assemblies. Having and maintaining a minimally functional supply chain in 2020 was deemed a “success” for many manufacturers.

In 2021 the challenge of resolving supply chains will persist; however, the consequences for failing to remedy such problems will have different consequences. The failure to manage your supply chain in 2021 may very well result in quickly spiraling input costs. There is a significant and growing chance of rising price inflation, especially in the durable goods industry. This has been made evident by rising material costs as evidenced by steel prices and steel futures.

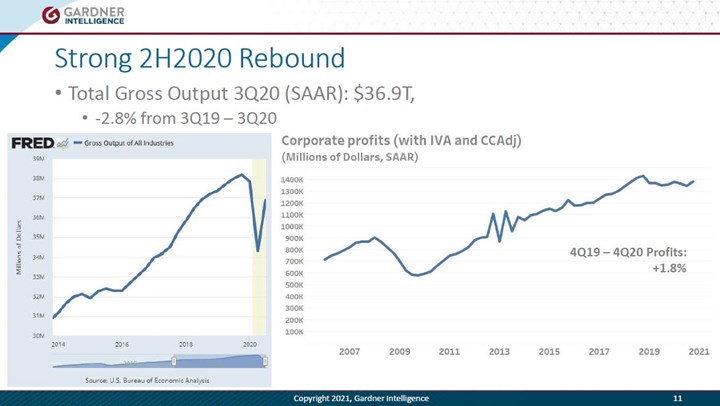

The second consequence of poorly managed supply chains in 2021 will be lost revenue opportunities. Government stimulus checks will drive rising consumer spending on durable goods while 2H2020 corporate profits will bolster capital expenditure spending in 2021. Manufacturers who fail to bolster and improve their supply chain performance now could thus suffer from both lost sales opportunities and weakening control over their production costs.

Present production challenges when combined with recently bolstered consumption spending thanks in part to 2021 stimulus checks and rising corporate profits will put additional demand on manufacturing in 2021. This will exacerbate the problem of rising costs and insufficiently capable supply chains.

.jpg;width=70;height=70;mode=crop)