September Cutting Tool Orders Highest Since March

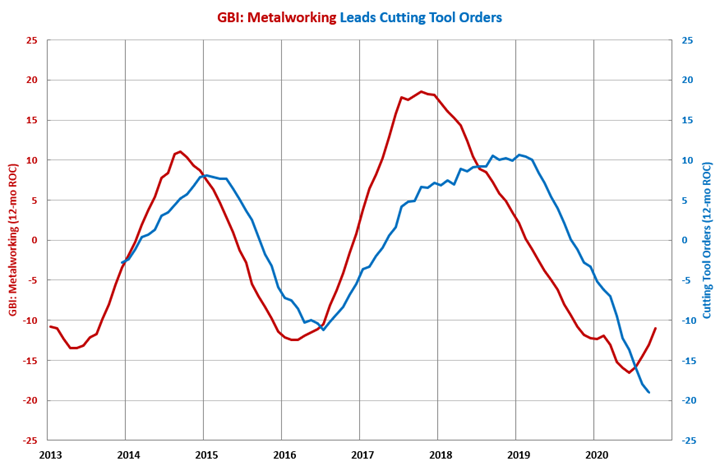

The GBI: Metalworking indicated that the annual rate of contraction in cutting tool orders should bottom out near the end of the year.

In September 2020, real cutting tool orders were $156.4 million, which was the highest order total since March. Compared with one year ago, cutting tool orders contracted -21.2%. While this was the 19th consecutive month of month-over-month contraction, it was the slowest rate of month-over-month contraction since March.

The annual rate of change contracted at an accelerating rate for the 12th month. The annual rate of contraction was 19.0%, which was the fastest rate of annual contraction since the data was made public. While the annual rate of contraction continued to accelerate, the one-month and three-month rates of change contracted at a slower rate, indicating that a bottom in the annual rate of contraction is near.

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. In October, the month-over-month rate of change in the index grew at an accelerating rate for the third month in a row. The annual rate of contraction decelerated for the fourth straight month, indicating that the annual rate of contraction in cutting tool orders will bottom near the end of the year.

.JPG;width=70;height=70;mode=crop)