Businesses Reporting Strong CapEx Spending Plans in 2H2021

As reported by the Philadelphia Federal Reserve, the May 2021 measure of expected capital spending is at a high not experienced since 2018. This should make for a very busy second-half to 2021 for upstream manufacturers including machine tool builders and suppliers of associated tools and accessories.

All indicators of anticipated capital expenditure spending are signaling strong growth over the rest of 2021 and in many cases well into 2022. Many economics outlets other than Gardner who cover the manufacturing industry suspect strong growth in the manufacturing space on the assumption that the present global vaccine roll-out —but especially in the developed world— continues as expected.

Expected U.S. GDP growth of 6-7% in 2021 and global GDP growth of around 5% for calendar year 2021 is expected to support a consensus 15% increase in machine tool and manufacturing spending in the U.S. Gardner Intelligence’s own proprietary data from U.S. manufacturers supports this outlook. In the four month period ending April of 2021, Gardner’s 12-month outlook of expected capital spending issued by 40%. Vastly greater expected spending by medium- and large-size manufacturers has driven an outsized portion of the increase in this reading.

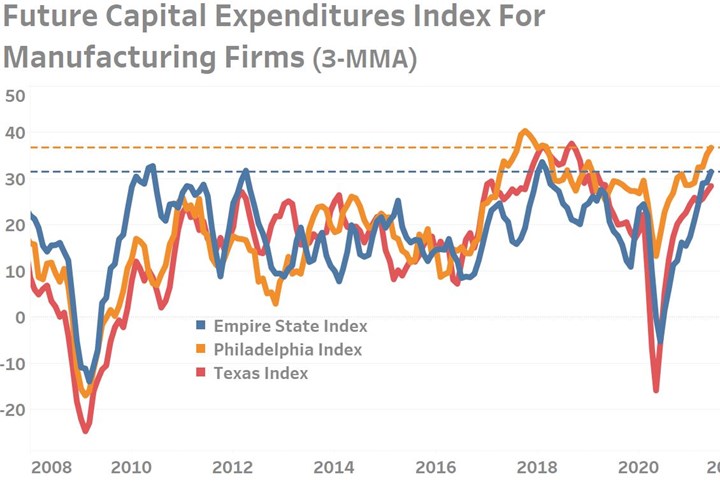

According to research conducted by the Federal Reserve Districts of New York, Philadelphia and Dallas, future expected capital spending based on a 6-month outlook has also risen sharply since the start of the year. The present readings for New York (Empire) and Philadelphia are comparable to 2018’s peak readings.

Data collected from three of the Federal Reserve’s District offices signal a strong rebound in capital expenditure spending is anticipated during the second-half of 2021. The Federal Reserve’s Future Capital Expenditures measures forecast the change in capital expenditures over the next six months for reporting manufacturing firms. The index values are calculated by taking the percent reporting increases and subtracting the percentage reporting decreases.

Actionable Insight:

The strong growth in capital expenditures will support a variety of upstream manufacturing markets well into the future. This demand “pull” on upstream suppliers only makes it more likely that supply chain problems will persist well into 2022. Manufacturing leaders should consider taking actions now which will help them mitigate the painful impacts of sluggish supply chains which are very likely to remain overwhelmed for at least another 6 to 12 months. In the case of specific products —specifically semiconductors— significant underinvestment in the pre-pandemic period means that supply chains may take much longer than 12-months to return to the pre-pandemic supply and demand equilibrium.

.jpg;width=70;height=70;mode=crop)