Wall Street Forecasts Ongoing Growth for Medical Industry

First quarter 2018 financial results show a solidly performing medical industry. Wall Street’s expectations are for improving growth through 2020. This is good for manufacturing firms supply durable goods to the medical industry.

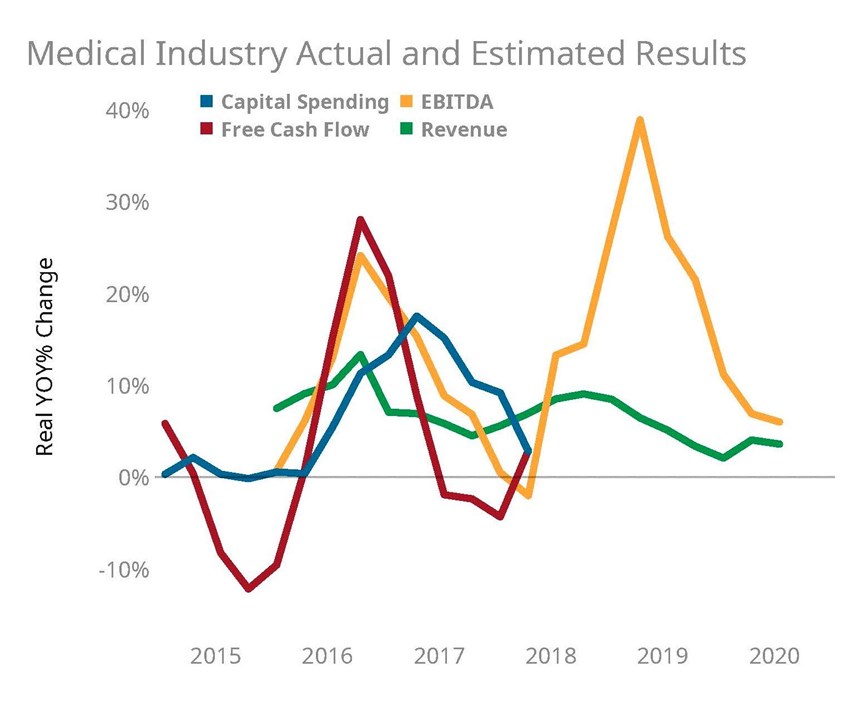

Gardner Intelligence’s quarterly review of the medical industry – based on Gardner’s proprietary data and the quarterly financial filings of 70 publicly-traded medical firms – revealed an industry that continues to see growing free cashflow and revenues. In the 12-month period ending with the first quarter of 2018, total free cashflow grew by nearly 3 percent after posting three prior quarters of contractions. At the same time, revenue growth was reported above 7 percent, and earnings before interest, taxes, depreciation and amortization (EBITDA) contracted by slightly less than 2 percent.

Importantly for the manufacturing industry, Gardner’s analysis indicates capital expenditure across the medical industry rose by 2.9 percent that year. The latest data illustrates a recent trend of slowing growth in capital expenditures after reaching a peak growth rate of over 15 percent during the first quarter of 2017. This may have been in part due to the industry rebounding from a lackluster 2015.

Wall Street forecasts for medical industry revenues and earnings are strengthening 2018 results with peak revenue growth occurring during the second half of 2018. Earnings forecasts suggest peak growth may occur during the first quarter of 2019, with initial earnings growth starting as early as the second quarter of 2018. Analysts expect earnings to return to long-term, single-digit levels by late 2019. Both forecasts imply near-term that the industry should be well positioned to increase research and development and capital spending well into 2019.

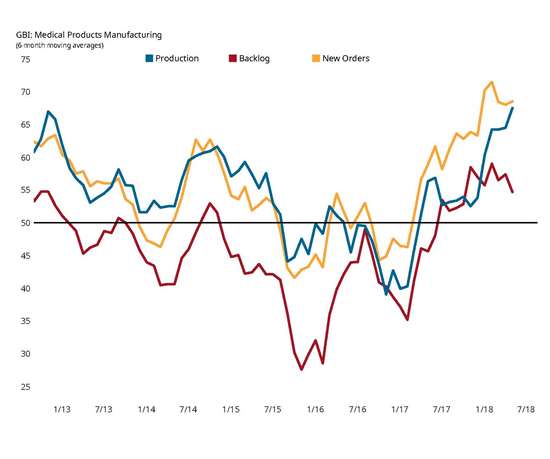

Data from Gardner’s proprietary business index of manufacturers supplying the medical industry supports Wall Street’s optimism. Medical manufacturers are reporting to Gardner that overall business conditions have been improving since early 2017, some of the best since 2012. Production and new orders are the fastest-growing business components within medical manufacturing. New orders growth during the second half of 2017 eclipsed production growth, resulting in recent backlog growth. Looking forward, manufacturers will need to produce not only to fill current orders, but also to work off backlog levels. This suggests that Wall Street’s optimistic expectations of the next several quarters are well founded.

.jpg;width=70;height=70;mode=crop)