Vehicle Market is Red Hot

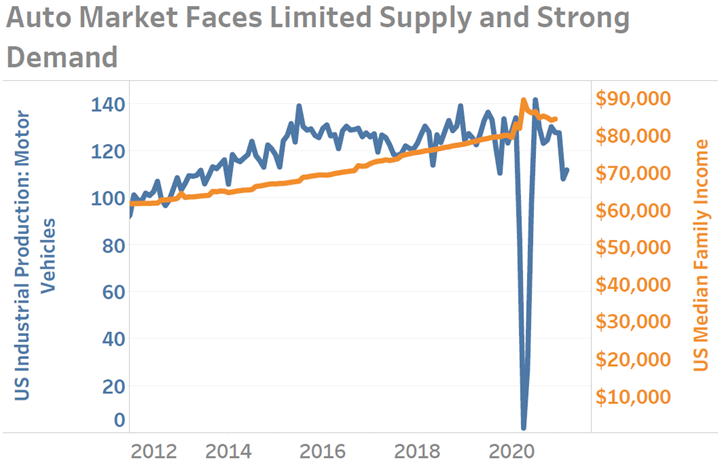

Recent months of vehicle sales have been suppressed by limited production resulting from supply chain disruptions. Despite repressed sales volumes due to limited supply, it is clear that demand for vehicles is red-hot when one examines pricing and loan data.

Prices for new and used vehicles continue to move higher as a result of a combination of influences. On the demand side, consumer spending has been bolstered by stimulus money which has supported an unprecedented increase in median family income. Further bolstering total spending is the rebounding jobs market which is seeing employers offering ever higher wages to fill critical vacant positions.

From the perspective of supply, production was not disrupted just once at the onset of the COVID-19 pandemic. Rather, vehicle production (supply) has experienced a string of supply-chain after-shocks since the initial COVID-19 shock of nearly a year ago, which saw factories forced to close and output fall to nearly nothing. The current combination of heightened income and limited output has created a very lucrative situation for the automotive industry as evidenced by the rising average price for new vehicles as well as for the pre-owned segment. The latest pricing data recorded an average new vehicle price in excess of $40,000 as consumers flock to large vehicles loaded with optional equipment. Manufacturers who can help to alleviate the production constraints for OEMs and their tier suppliers could find themselves in a lucrative position.

A surge in family income in 2020 coupled with restrained vehicle production has resulted in sharply rising prices for both new and used motor vehicles.

.jpg;width=70;height=70;mode=crop)