Rising Inflation Sends the Real 10-Year Treasury Rate to Its Lowest Since Nov. 2011

The inflation rate reached 2.62% in March. Even though the nominal 10-year Treasury rate rose for the eighth month in a row, this significantly higher rate of inflation since the real 10-year Treasury down to -1.01%, which was the lowest real rate since November 2011.

In March, the nominal 10-year Treasury rate was 1.61%, which was the eighth month in a row that the nominal rate increased. Also, this was the highest rate for the 10-year Treasury since January 2020. Of course, historically, the current rate is extremely low.

While the nominal 10-year Treasury rate was rising, the real 10-year Treasury rate was falling to its lowest rate since November 2011. The reason for this was that the rate of inflation increased to 2.62% in March, which was the highest rate of inflation since August 2018. As the real 10-year Treasury rate is the nominal rate minus the inflation rate, the real 10-year Treasury rate was -1.01% in March.

After two months in positive territory, the year-over-year change in the real 10-year Treasury rate fell back below 0 to -0.34%. Therefore, the change was negative for 18 of the last 20 months.

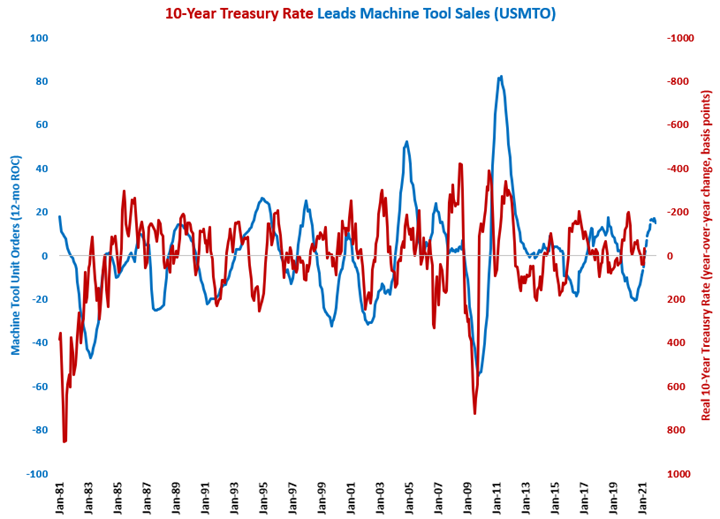

As much as the absolute level of interest rates, it is the relative change in interest rates that drives additional borrowing and spending. A falling change in the real 10-year Treasury rate tends to be a positive signal for durable goods manufacturing. Falling changes in the real 10-year Treasury rate tend to lead to expansion in durable goods new orders and capital equipment consumption by a relatively long period of time – historically, between 12 and 24 months. The falling change in the 10-year Treasury rate is a good leading indicator of future contraction in housing permits, construction spending and consumer durable-goods spending as well.

.JPG;width=70;height=70;mode=crop)