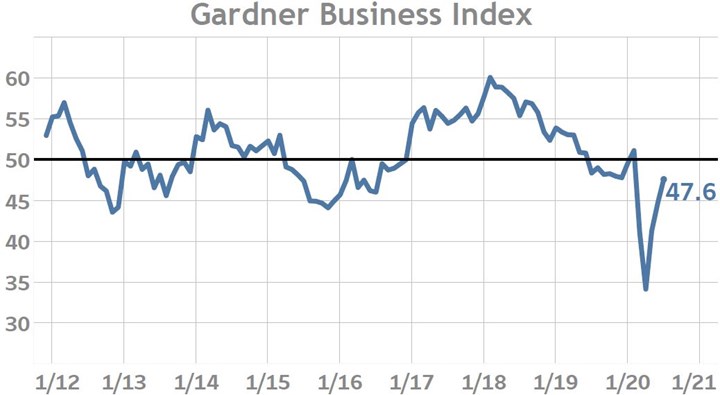

July Business Index Reports Third Consecutive Month of Slowing Contraction

The Gardner Business Index reported its third month of slowing contraction in July.

The Gardner Business Index at 47.6 registered a third month of slowing contraction for July. Rising readings below a level of 50 indicate a slowing rate of contracting business activity. This occurs when there is a decline in the proportion of manufacturers reporting worsening conditions relative to the prior month. Of the six components which constitute the Index, only supplier deliveries registered above 50. As explained previously in detail, the recent elevation in supplier delivery readings is a result of disrupted supply chains rather than the result of economic growth. All other components registered slowing contraction led in absolute terms by new orders (up 4-points) and followed by production (up 3-points). The reading for export activity also increased in July by nearly 4-points. As domestic and international demand continue to show signs of improvement, other measures of business activity can be expected to improve in the coming months. Historically, production lags new orders by one month while backlogs and employment activity lag new orders by two or more months.

The Gardner Business Index reported its third month of slowing contraction in July. Across the manufacturing spectrum, several manufacturing technologies even reported expanding business conditions.

All geographic regions of the U.S. reported slowing contraction for the month with the Northeast reporting the least level of economic contraction and the Southeast reporting the greatest. The North Central East region comprising of Indiana, Kentucky, Michigan, Ohio and Tennessee reported the greatest change in activity during July with a 5-point gain.

By company size, firms of between 100 and 250 employees reported a second consecutive month of expanding business activity. Joining them with an expansionary reading for the first time since March were firms between 50 and 99 employees. All other size categories reported slowing business activity contraction with firms between 1 and 19 employees reporting relatively greater levels of contracting activity than all other size categories.

Gardner Intelligence does its utmost to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and ongoing support. We hope that you will continue to let us know how you are faring. Only through your participation are we able to assess the current industry and see where it is heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.

.jpg;width=70;height=70;mode=crop)