Credit Data Signaling Possible Working Capital Squeeze

Banking data signal rising demand from companies for credit. This may support ancedotal evidence that a rising proportion of firms are struggling with limited working capital.

The Gardner Business Index (GBI) first reported unusually slow supply chain performance as early as April of 2020. In the 16-months which have since followed those early concerning readings, manufacturers have faced countless operational and logistical challenges. Lengthening order-to-delivery times coupled with rising material costs and rising employee wages all signal that manufacturing is more expensive than ever; hence operations are requiring more working capital than just months ago. Thanks to government funding, many firms were able to apply for and receive critical cash which supported operations in 2020 and allowed credit market indicators to remain positive during that time according to the data from the National Association of Credit Managers (NACM). Now that such programs are in their twilight, if not fully ended, firms must return to traditional credit markets to fund their operations.

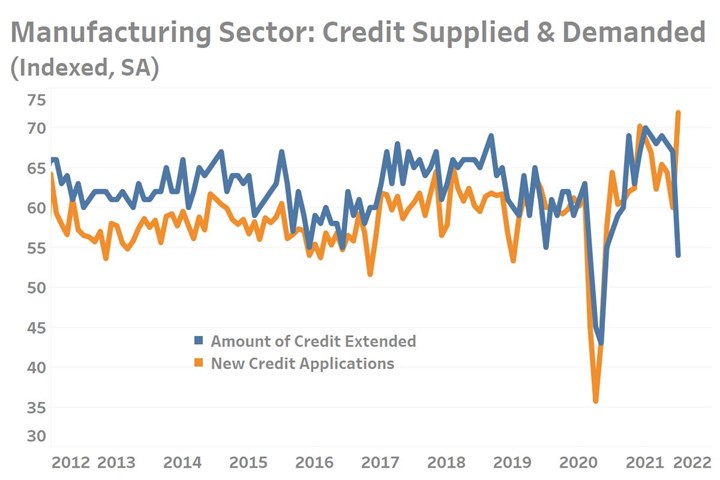

Data collected during the first half of 2021 from the NACM indicated that the index reading of credit extended -measured as a function of the proportion of banks willing to extend credit to manufacturers- exceeded a comparable measure representing manufacturers’ applications for credit. Historically the reading for credit extended exceeds the same month reading for new credit applications. It is for this reason that the July 2021 readings were a surprise, with the reading for new credit applications unexpectedly jumping by 12-points while credit extended fell by 13-points. This not only upset the traditional relationship between manufacturing credit supplied and demanded, but generated the greatest credit market ‘deficit’ since at least 2006, surpassing the worse months of both the Great Recession and the shutdown of the economy in early 2020.

Index readings for Credit Applied for by Manufacturers and Credit Extended by Banks both made sharp moves in July, resulting in the widest credit ‘deficit’ since at least 2006 according to data from the National Association of Credit Managers.

The impact of this inversion on manufacturers will depend greatly on its duration and if credit extended actually begins to contract, recognized as an index reading for Credit Extended below a value of ‘50’. The July credit extended reading of 54.0 only means that a declining majority of banks are either extending more or the same amount of credit as in June. That this reading fell from a historically high level of 67.0 just one-month prior also needs to be kept in perspective. Overall manufacturers should simply beware that credit availability maybe at risk and that it may be prudent to examine your credit strategy and ability to handle a potential near-term dry spell in the credit markets.

.jpg;width=70;height=70;mode=crop)