April Cutting Tool Orders Drop As Expected

The annual rate of contraction in cutting tool orders was 9.5%, which was the fastest rate of contraction since August 2016. This contraction was as expected based on the Gardner Business Index.

In April 2020, real cutting tool orders were $142.9 million, which was the fifth time in six months that orders were below $190 million. Also, this was the lowest level of cutting tool orders since the data was made public in January 2012. Compared with one year ago, cutting tool orders contracted -31.8%, which was the fastest rate of contraction on record and marked the 14th consecutive month of month-over-month contraction. In five of the last six months, orders have contracted faster than 9.5%. The annual rate of change contracted at an accelerating rate for the seventh month. The annual rate of contraction was 9.5%, which was the fastest rate of contraction since August 2016. This contraction was as expected based on the Gardner Business Index.

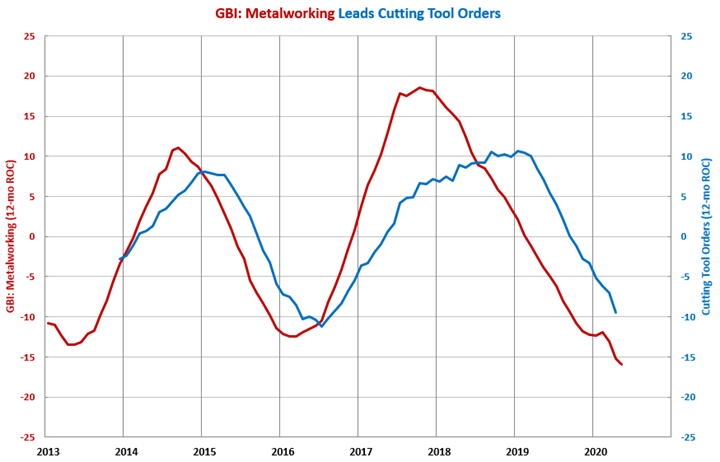

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. The annual rate of change in the Index has contracted for 15 straight months, clearly indicating that the annual rate of contraction in cutting tool orders will continue to accelerate. Due to the effects of the coronavirus, the GBI annual rate of contraction accelerated since March. A bottom in the annual contraction of cutting tool orders cannot be expected until seven to 10 months after a bottom in the GBI annual rate of change.

.JPG;width=70;height=70;mode=crop)