March Machine Tool Orders Most Since March 2019

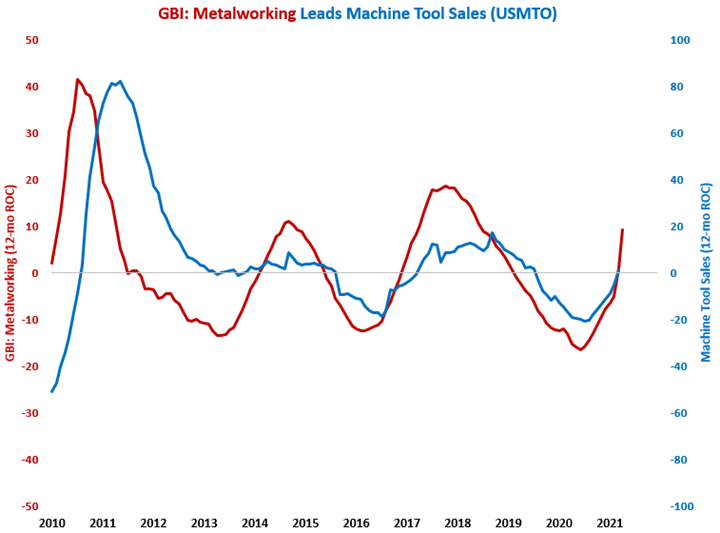

Machine tool unit orders increased 45.1% in March compared with one year ago. While the rapid growth rate was partly due to an easy comparison with March 2020, March 2021’s 2,368 units ordered was the highest monthly unit total since March 2019. Strong growth in the GBI: Metalworking is indicating further strong growth in machine tool orders.

According to the United States Machine Tool Orders (USMTO) report published by the Association For Manufacturing Technology (AMT), March machine tool orders were 2,368 units and $420,763,000.

Unit orders in February increased 45.1% compared with one year ago, marking the sixth month of growth in the last seven months. March’s month-over-month rate of growth was the fastest since September 2016. While the rapid growth rate was partly due to an easy comparison with March 2020, March 2021’s 2,368 units ordered was the highest monthly unit total since March 2019. Therefore, March was an excellent month for machine tool orders no matter how you analyze the data. As a result, the annual rate of change grew 0.9%, which was the first month of growth since July 2019.

In January, real dollar orders increased 34.8%. This was the fastest rate of growth since September 2018, but the real dollar total was only the highest since December 2020. Surprisingly, given all of the supply chain issues and strong demand for machine tools, the average price of machine tools in March decreased 7.1% compared with one year ago (largely due to the Southeast region). The annual rate of contraction in dollar orders decelerated for the eighth month in a row to 4.8%, its slowest rate since July 2019.

Month-over-month rates of change differed wildly among the six regions. February orders were dominated by the North-Central West and East regions.

Region Units Dollars

West 37.5% 36.0%

South Central 63.9% 83.9%

North-Central West 75.6% 82.2%

North-Central East 41.2% 34.5%

Southeast 23.0% -47.2%

Northeast 44.1% 62.7%

Compared with one year ago, the GBI: Metalworking was 80.8% higher, which was the ninth consecutive month of growth and the fastest rate of growth in the history of the GBI. The annual rate of change in the GBI grew 9.2% in April, which was the second straight month of accelerating growth. It is clear that the annual rate of change in machine tool orders has already bottomed ahead of schedule.

.JPG;width=70;height=70;mode=crop)