Steelmakers' Early COVID Pessimism Results in End of Year Supply Shortages

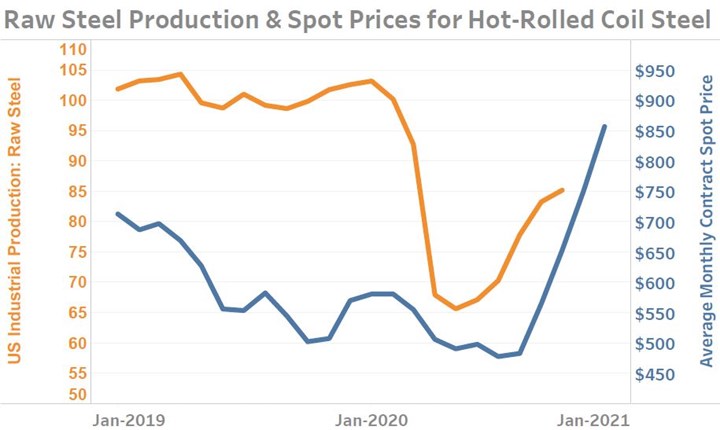

Iron ore and steel prices increased sharply during the second half of 2020 as strong demand caught suppliers who shuttered plants earlier in the year off-guard. The steel industry had been facing eroding spot prices for more than a year before COVID was classified as a pandemic in March. After watching spot prices fall throughout 2019 and then fearing additional strain on the industry due to the spread of COVID across the world—and especially in the US—it is all too reasonable to understand why the industry shuttered large amounts of production early on in 2020.

In the years leading up to the COVID pandemic, steel prices had been quite volatile. Spot prices for steel coil during September of 2017 sold for as little as $590 per 20-ton contract. This was short-lived as contract prices quickly climbed over the following eight months with some May contracts selling in excess of $925. From here, contract prices experienced a sharp correction over the next 16-months as prices fell by 40% to around $550 per contract. During this period of significant price volatility, steel production was relatively less sensitive to changes in finished steel prices. This is not unusual for industries with high fixed costs.

Measures of raw steel production remained little changed during 2019 while steel prices fell. Many steel firms were thus in a weakened position when COVID began taking its severe toll on the economy in the following year. Contract prices are averages of higher-frequency data calculated by Gardner Intelligence from www.investing.com. Industrial Production figures from the Federal Reserve.

The steep fall in prices and elevated level of production at the end of 2019 placed the industry in a particularly difficult position at the onset of the COVID pandemic which would soon see major industries—and in particular automotive production—almost completely shutdown. The ensuing market disruption resulted in the steepest fall in steel production since the Great Recession in 2008 and prior to that in the early 1980s.

As the initial shock during the first half of 2020 faded, steel industry executives would have to make operating decisions based largely on their assumptions about the timing and shape of an eventual market rebound. Cleveland-Cliff’s Chairman, Lourenco Goncalves, said during his company’s third-quarter 2020 Earnings Conference Call:

“Our strong third-quarter results reflect the positive outcome of the actions we took in Q2, when we saw opportunity when others were paralyzed. During the almost three months when our main market, the automotive industry, went through unprecedented shutdowns across the entire sector, we prepared our inventories and our plants to be ready as soon as our clients were back in business. As a direct consequence of that, we generated $150 million in free cash flow during the quarter.”

(As reported by: https://www.businesswire.com/news/home/20201023005077/en/Cleveland-Cliffs-Inc.-Reports-Third-Quarter-2020-Results)

This mindset has clearly benefited Cleveland-Cliffs and others like them who have prepared themselves for the stronger and quicker-than-expected rebound already being felt this year. Domestic consumerism in recent months has seen price inflation resulting from demand exceeding available supplies for everything from medical goods to a whole host of unexpected goods such as high-ticket vehicles, RVs, boats and even the humble kids’ pedal bicycle. Should this trajectory continue in light of the recent distribution of highly effective vaccines, manufacturing’s greatest problem may not be one of chasing limited demand, but of limited supplies resulting in empty shelves in the face of wanting buyers.

During the final quarter of 2020, Gardner Intelligence has pressed the case for manufacturers to prepare for 2021 by focusing their efforts to strengthening the durability of their supply chains. Should demand for goods continue to rebound and exceed expectations as they have in recent months, and as efforts generally increase to re-shore U.S. supply chains, it will be essential for U.S. manufacturers in the immediate future to improve the durability of their supply chains and supply networks.

.jpg;width=70;height=70;mode=crop)