Money Supply Growth Slows in April

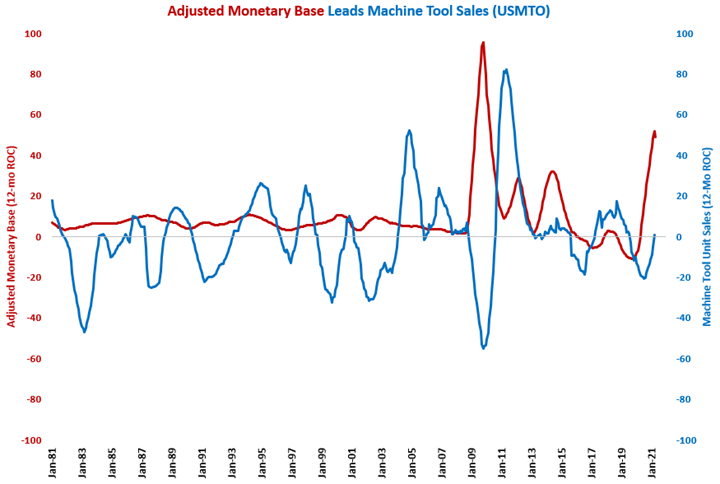

The month-over-month rate of growth in the money supply slowed for the second straight month, and the annual rate of growth slowed for the first time in 12 months. However, the annual rate of growth is the fastest ever outside of a few months during the Great Recession. This strong growth should lead to accelerating growth in capital equipment consumption for the remainder of 2021.

In April 2021, the monetary base was $6.042 trillion, which was the highest level ever and the first time the monetary base was more than $6 trillion. Compared with one year ago, April’s monetary base was up 24.7%, which was the 17th consecutive month of growth. However, it was the second month in a row of decelerating growth and the first time the month-over-month rate of growth was below 44% since March 2020.

Much of the coronavirus stimulus from the government is still in place. Further, just prior to this writing, President Biden announced his planned budget for the next fiscal year of $6 trillion, which would be the highest relative to GDP since World War II.

The annual rate of growth decelerated to 48.9% in April, which ended 12 straight months of accelerating growth. Based on the monthly and quarterly trends in the money supply, it is likely that the annual rate of growth in the money supply has reached its peak rate of growth.

Historically, the annual rate of change in the monetary base leads capital equipment consumption, specifically machine tool orders, by 12-18 months. Although, the lead time between the monetary base and capital equipment consumption shrunk over the last decade. The recent rapidly accelerating growth in the monetary base should eventually lead to rapidly accelerating growth in machine tool orders and capital equipment in general. It is likely that machine tool orders bottomed in August.

.JPG;width=70;height=70;mode=crop)