Gardner Business Index: September 2020

The Gardner Business Index reported a second consecutive month of expansionary activity in September. Large manufacturers and those serving the automotive and medical industries helped propel the Index higher.

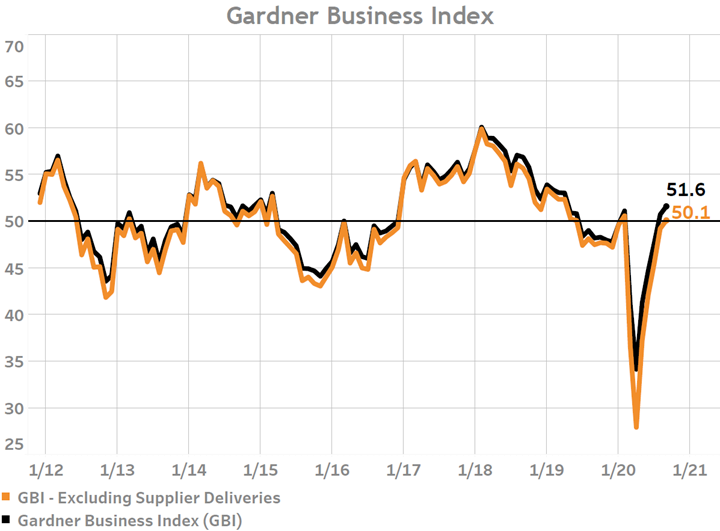

The Gardner Business Index (GBI) reported expanding activity during September with a 51.6 reading; marking a second month of expanding business activity. Readings above a level of 50 indicate expanding business activity. The further a reading is above 50 the more broadly that change in business activity is being observed as compared to the prior month. During September supplier deliveries, production and new orders all reported above-50 readings, propelling the Index above 50 for the first time since COVID. This month employment activity joined the list of business activity components experiencing expansionary activity, leaving only backlogs and export orders to report slowing contraction. As previously reported, COVID’s disruption to manufacturing supply chains in 2020 has resulted in inflated supplier delivery readings and thus higher overall Index readings. Removing supplier delivery’s inflationary influence from the Index’s calculation, September would have marked the first month since February that the GBI has reported overall expanding business activity levels.

The Gardner Business Index with and without the influence of Supplier Delivery activity. Data as of September 2020.

The latest end-market data from the Index’s results indicate that a growing list of markets are shifting from contractionary to expansionary business conditions. Of the 20 end-markets which Gardner Intelligence tracks, nine reported expansionary activity in September. Manufacturers serving the Medical and Industrial Motors markets reported expanding activity in these markets, adding to the seven other end-markets which had already reported expanding activity since at least August.

September’s results further extended the dichotomy in business conditions being reported by firms of different sizes. Since June, larger firms have reported overall better business conditions as compared to smaller firms and in particular those with fewer than 20 employees. Reported new orders activity has been a particularly acute differentiator with large firms having reported since June that new orders activity has been expanding at an accelerating level. In contrast, small firms since February have reported only varying levels of contracting new orders activity.

Gardner Intelligence does its utmost to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to tell us how your businesses are faring. Only through your participation are we able to assess the current industry and see where it is heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.

.jpg;width=70;height=70;mode=crop)