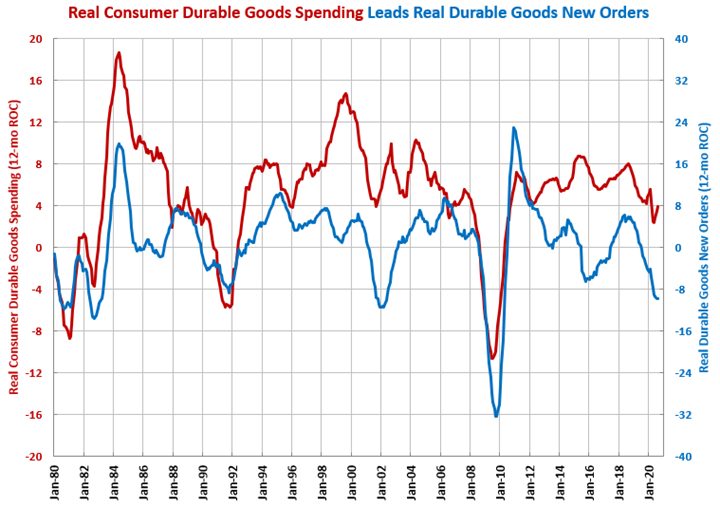

Durable Goods New Orders Nearing a Bottom

A burst in consumer durable goods spending indicates that the annual rate of contraction in durable goods new orders may be near a bottom.

New orders for real durable goods totaled $232,626 million in August. This was 7.0% less than one year ago. The month-over-month rate of contraction peaked in April at 31.3%.

The result was that the annual rate of change contracted 9.9%, which was the fastest rate of annual contraction since April 2010. However, consumer durable goods spending hit an all-time high for three months straight. Therefore, consumer durable goods spending is indicating a bottom in the rate of contraction in durable goods new orders may be near.

It’s important to note that aerospace orders in August were negative for the fifth time in six months and non-defense aerospace orders were negative for the sixth consecutive month.

Accelerating Growth:

Decelerating Growth: appliances, ship/boat building

Accelerating Contraction: aerospace, construction materials, durable goods, fabricated metal products, motor vehicle/parts, oil/gas-field/mining machinery, power generation, total capital goods

Decelerating Contraction: computers/electronics, HVAC, machinery/equipment, off-road/construction machinery, primary metals

.JPG;width=70;height=70;mode=crop)