Cutting Tool Orders Show Signs of Improvement

February cutting tool orders were the third highest since the economic lockdown started in March 2020. And, the GBI: Metalworking reached an all-time high in March on strength in new orders, production, and backlogs. This indicates that cutting tool orders should see strong growth in the second and third quarters of 2021.

According to the Cutting Tool Management Report (CTMR) for February 2021 from the Association For Manufacturing Technology (AMT), real cutting tool orders were $149.5 million, contracting 18.5% from February 2020. This was the slowest rate of contraction since March 2020 at the start of the economic lockdown. It is likely that the February orders were affected by the deep cold in Texas and/or significant supply disruption that, among other effects, forced plant shutdowns in the automotive industry due to a lack of computer chips. February was the 24th consecutive month of month-over-month contraction, but these same figures clearly show that the contraction is slowing. Further, starting in April, the month-over-month comparisons get much easier.

The annual rate of change contracted at an accelerating rate for the 17th month. The annual rate of contraction was 27.4%, which was the fastest rate of annual contraction since the data was made public. The annual rate of contraction may be at its fastest in February, depending on the strength of March orders.

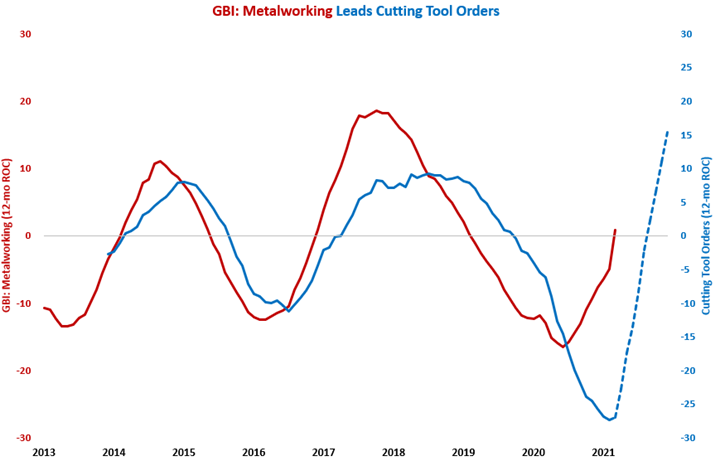

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. In March, the index was above 50 for the sixth month in a row and the month-over-month rate of change in the index grew for the eighth consecutive month and March’s rate of growth was the fastest since July 2010. The annual rate of change grew for the first month since February 2019, indicating that the annual rate of contraction in cutting tool orders should be at a bottom.

In the chart below, the dotted blue line represents the possible recovery in cutting tool orders. The forecast calls for cutting tool orders to grow by 15.4% in 2021 compared with 2020. The rate of recovery is faster (or steeper) than the previous two growth cycles for cutting tool orders because of the comparison in 2021 to periods of economic lockdown in 2020. This projection is relatively modest when compared with actual levels of historic cutting tool orders. One reason for this is that supply chain disruption may slow the manufacturing recovery.

.JPG;width=70;height=70;mode=crop)