Consumer Durable Goods Spending Hits All-Time High for 3rd Straight Month

Spending patterns are changing due to the pandemic. Service and experience items are out. Goods that allow more isolated entertainment or tie in with a life of working from home are in.

In August, real consumer durable goods spending was $1,998,489, which is an all-time high for the third consecutive month. The month-over-month rate of growth for durable goods spending was 11.2%, which was the second-fastest rate of growth since January 2015. Also, it was the third straight month with faster than 11% growth, which was the first time that has happened since the summer of 1999.

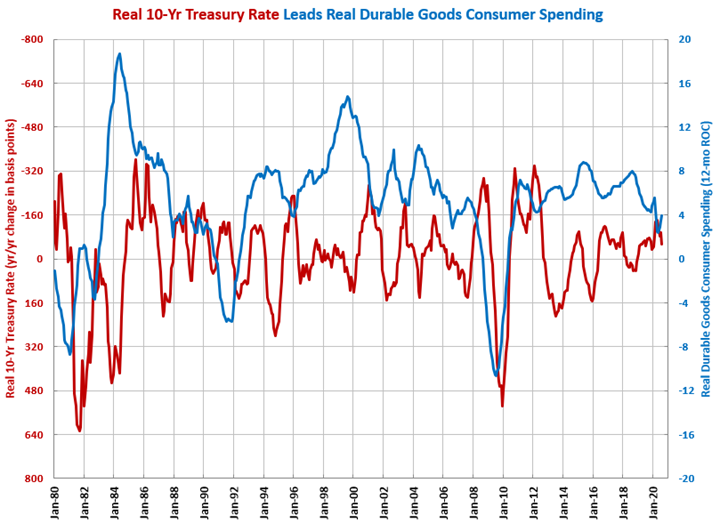

The annual rate of growth accelerated for the third straight month to 4.0%. The real 10-year Treasury rate, which is the nominal rate minus the rate of inflation, was -0.81%. This was the eighth consecutive month and 11th of the last 13 that the real rate was negative. So far, lower interest rates combined with increased government transfer payments and the stock market at all-time highs have been enough to significantly boost durable goods spending. The question is, will that continue when government transfer payments run out?

While consumer durable goods spending is booming, total consumer spending is collapsing. There truly are two economies right now. Consumer durable goods spending is growing at record rates. Meanwhile, total consumer spending is contracting at its fastest annual rate since at least December 1960, which is as far back as the data goes.

Travel, healthcare and restaurant spending, really anything service-related, has collapsed. So has spending on clothing as everyone works from home. Meanwhile, motor vehicle and parts, appliance, electronics and boat spending have held up quite well or grown extremely fast during the pandemic. Spending has shifted from service/experience oriented items to goods or devices that afford isolated entertainment and cars as people move from congested cities to suburban or rural areas.

Below are key spending categories that lead the most important manufacturing new orders and production indices.

Accelerating Growth: durable goods, electronics, food/beverage, other non-durable goods, pleasure boats

Decelerating Growth: appliances

Accelerating Contraction: air transportation services, clothing/footwear, medical care, total consumer

Decelerating Contraction: motor vehicles/parts

.JPG;width=70;height=70;mode=crop)