Capacity Utilization: All End Markets Contracting Faster

In May, durable goods capacity utilization was 57.1%, which was a modest improvement over April. Compared with one year ago, capacity utilization contracted 24.4%.

In May, durable goods capacity utilization was 57.1%, which was a modest improvement over April. Compared with one year ago, capacity utilization contracted 24.4%, which was the third fastest rate of month-over-month contraction ever. This was the 12th month in a row and the 13th of the last 14 months that capacity utilization contracted.

The annual change in durable goods capacity utilization contracted at an accelerating rate for the seventh month in a row, falling to -6.5% from -4.5%. May was the fastest rate of annual contraction since April 2010. As the annual rate of change tends to lead capital equipment consumption by seven-to-10 months, capacity utilization is signaling accelerating contraction in capital equipment spending through at least into the third quarter of 2020 and likely through the remainder of the year.

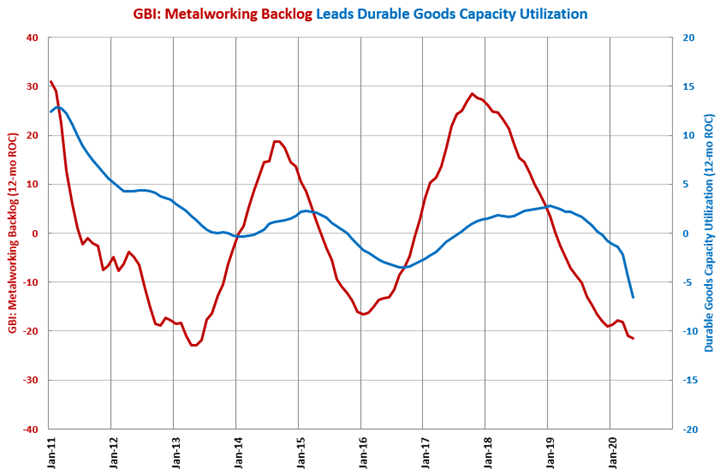

The GBI: Metalworking backlog index tends to lead the annual rate of change in capacity utilization by seven-to-10 months. Since the pandemic began, the annual rate of contraction in the Backlog index has contracted at an accelerating rate. The Backlog index is indicating that the accelerating contraction in durable goods capacity utilization will continue through the summer.

Accelerating Growth:

Decelerating Growth:

Accelerating Contraction: aerospace, automotive, construction materials, custom processors, durable goods, electronics/computers, food/beverage processing, forming/fabricating (non-auto), furniture, machinery/equipment, petrochemical processors, plastics/rubber products, primary metals, printing, textiles/clothing/leather goods, wood/paper products

Decelerating Contraction:

.JPG;width=70;height=70;mode=crop)