April Income Skyrockets Due to Government Transfer Payments

April was the highest level of real disposable income by $1.8 trillion, or roughly 12% more than the previous all-time high.

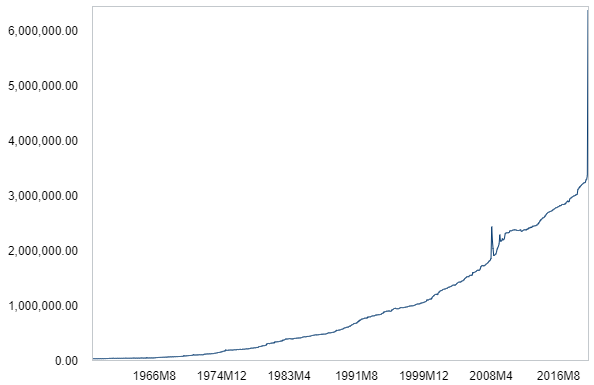

In April, real disposable income was $16,965 billion, which was 13.8% more than one year ago. This was the highest level of real disposable income by $1.8 trillion, or roughly 12% more than the previous all-time high. Of course, the increase in disposable income was not a result of organic growth in the economy given the dramatic increase in unemployment due to the pandemic. Instead, the massive increase in income was a direct result of government transfer payments (e.g. unemployment).

Transfer payments in April 2020 were nearly double what they were in March 2020. Also, the $3 trillion increase in transfer payments dwarfed the increase in transfer payments during the Great Recession in 2008-9.

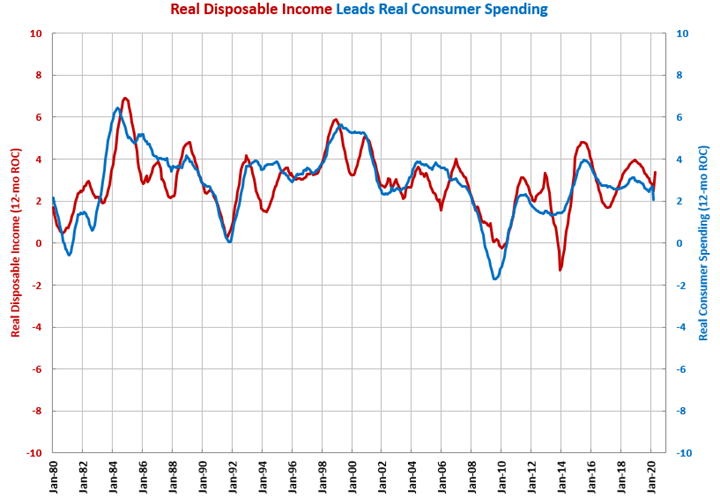

The annual rate of growth accelerated to 3.4%. This was the fastest rate of annual growth since July 2019. Normally, this kind of acceleration would lead to a dramatic increase in consumer spending.

The one-month rate of change in real disposable income increased 13.8% in April, driving up the annual rate of growth in income to its fastest rate since July 2019.

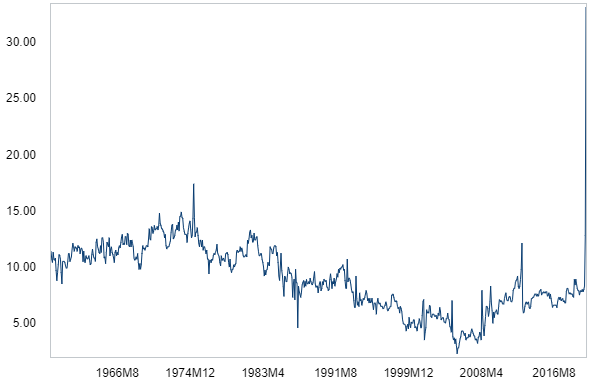

However, the savings rate in April was the highest level ever, indicating that the dramatic increase in income from transfer payments was not used to fuel additional consumer spending.

The personal savings rate (savings as a percent of disposable income) in April reached an all-time of 33% that dwarfed the previous high in May 1975.

Economic shocks of the magnitude of the pandemic typically create significant outliers in economic data points. So, it may take several months to discern new trends in the data.

Keep in mind that changes in real disposable income typically lead capital equipment consumption by almost 24 months.

.JPG;width=70;height=70;mode=crop)