The Federal Reserve’s Blunt Tools for Managing Interest Rates Lack the Precision to Achieve Post-COVID Economic Goals

The last 25 years of data of the Federal Reserve Bank’s Fed Funds rate, corporate loan rates, inflation and economic growth testify to the complexities of the modern economy. The data reviewed in this piece provide recent examples of just how unpredictable the economy can be and just how little control the Fed has when trying to construct a particular economic outcome.

Author’s Preface: I started this piece never anticipating that it would reach over 1,200 words or have me referencing economics textbooks. For this reason, I will share with you my conclusion in brief: The last 25-years of data of the Federal Reserve Bank’s Fed Funds rate, corporate loan rates, inflation and economic growth testify to the complexities of the modern financial system. The data reviewed in this piece provide recent examples of just how unpredictable the economy can be and just how little control the Fed has when trying to construct a particular economic outcome. Recent communications by the Federal Reserve indicate that they will let the economy run “hot” and allow inflation to rise above 2% for a determined amount of time before throttling back the economy to the point at which inflation falls to 2%. Such a plan is bold, ambitious and desirable, but almost certainly beyond the ability of the best minds when they have only blunt tools at their disposal and are exposed to the independent actions of governments and other large financial actors which act in ways that frequently and significantly impact the economic landscape in their own right.

Borrowing costs in 1Q2021 have been rising after spending 2020 at multi-decade lows. The historical fall was in part driven by the Federal Reserve Bank’s (“The Fed’s”) relentless push to lower the cost of borrowing money (that is, the interest rate paid on a loan) and by extension encourage businesses and consumers to “pull forward” their consumption, thereby bolstering the economy in the near-term. Lower interest rates both make a wider range of investments profitable, and increase an already profitable investment’s return. It is for this reason that the Federal Reserve at certain times adjusts the Fed Funds rate which indirectly influences other interest rates in the same direction and in doing so either encourages (by downwardly influencing loan rates) or discourages (by influencing rates to move higher) firms from borrowing and spending capital.

While it may be tempting to simply hold down rates all the time to maximize every investment’s ROI and grow the economy at maximum speed, doing so can lead to rising prices (a.k.a. inflation) as too few available resources/materials exist to meet current demand. If every company simultaneously embarked on a grand investment project, there would be nowhere close to enough materials and laborers to meet the needs of the investors. Each project would have to compete against other projects for limited resources by bidding up or “inflating” the price of materials and offering even more lucrative wages to complete their desired project now.

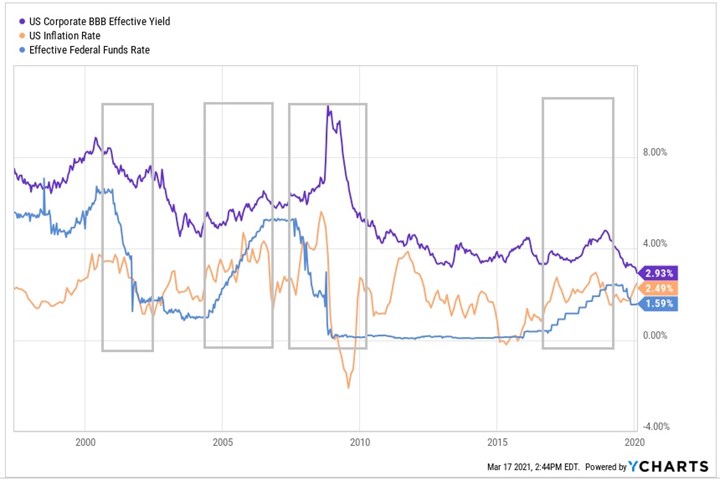

The same theory applies in reverse. Raising the Fed Funds rate indirectly raises interest rates, increasing the cost of borrowing money and reducing investment returns. The higher costs of borrowing would discourage some projects from ever beginning, lowering demand for materials and labor. Despite this seemingly straightforward understanding of how interest rates affect the economy, the last several decades of data illustrate that the Fed Funds Rate is at best a blunt tool with little certainty of its affect. This is largely because other events can overwhelm the influence of the Fed’s rate targets. The following graph illustrates the history of the Fed Funds rate, the BBB corporate yield rate which represents the “cost” (that is the interest rate) that firms pay to borrow money for making investments and the rate of inflation which broadly tracks the change in the price of goods. As can be seen from the graph, the idea that the Federal Reserve can suppress interest rates during COVID, then allow inflation to rise in a controlled manner marginally above 2% and then ease back inflation to a 2% target, is highly skeptical. It is analogous to a doctor using a very blunt instrument to perform a very precise surgery while also being pushed around by football linebackers. The following is a non-exhaustive list of issues which make the work of the Fed extremely difficult.

The ability of the Federal Reserve to use its Fed Funds Rate to decisively and predictably adjust inflation and corporate borrowing costs is at best dubious. The recent messaging from the Fed that they can precisely control these powerful matters of financial markets should be taken with suspicion.

1. The Fed Funds rate is NOT directly tied to the interest rates applied to corporate borrowings.

In reality, it is a special lending rate that only affects borrowing between the Federal Reserve and large banks for overnight money. It therefore only indirectly influences the interest rates cited by banks when loaning money to private borrowers. In the left-most box of this article’s graph, the Fed lowered the Fed Funds rate by 5.0% between late 2000 and 2001, yet this had only a 0.75% effect on the BBB Yield which is the basis of the interest rate paid by many manufacturers when borrowing capital. Similarly, in the right-most box, the Fed steadily increased interest rates. This had at best a modest effect on business borrowing costs. At the same time, the rate of inflation increased slightly when theory would have suggested a decrease. Both instances exemplify how the results of the Fed’s rate decisions can vary in both their timing and magnitude on business borrowing.

2. Other highly influential forces affect financial markets and prices besides the Federal Reserve.

Unprecedented government spending during the Great Recession has since encouraged the Treasury and Congress to inject incredible amounts of money into the economy using complex stimulus bills which have unpredictable effects. Over the course of the COVID pandemic through the first quarter of 2021, U.S. public debt increased by roughly $6 trillion. This represents 28-percent of the total size of the U.S. economy according to the latest Bureau of Economic Analysis data. Of this, slightly more than half of this was financed by the Federal Reserve’s purchasing of U.S. Treasury debt. This means that the collective efforts of non-Fed actors -who may not have the same goals as the Federal Reserve- played nearly as great a role as the Fed in financing recent stimulus packages and the unpredictable future effects they will have in the future.

While the goal of these measures is to stimulate the economy through consumption spending, in 2020 it also resulted in significant price inflation for many goods. RVs, cars, appliances, pedal-bicycles and other popular goods saw significant price increases. The combination of strong consumption demand supported by stimulus legislation coupled with legislation that in recent time has restricted manufacturing capacity has resulted in surprisingly brisk price increases in recent months.

3. Financial Markets and Economic Expectations Drive Interest Rates and Inflation Expectations.

The past 25 years of financial data illustrate two periods of rising and two periods of declining Fed Funds rates. In none of these cases, however, does the movement of the Fed Funds rate correspond with the expected movement in actual inflation. Nor in each event did the change in Fed behavior result in a strongly correlated, directionally predicted change in the interest rate charged for corporate borrowings. One explanation for this comes from understanding that interest rates charged by banks to private companies are highly subject to the supply of money available to lend and the demand for such money. In a sense, money can be thought of like any other commodity or good while its “price” is the interest rate charged for its being lent to a borrower. The supply and demand of money has an incredibly strong influence on the interest rates that matter to private borrowers.

4. Even the Smartest Economists Disagree Over Precisely How to Manipulate the Monetary System.

Similar to science and medicine, as the world’s understanding of economics expands and deepens with time, the more we realize just how much is left to be understood. This very brief review of the last 25 years of data focuses on just one of multiple economic theories around the monetary system and just one of the Federal Reserve’s many tools for influencing the economy. The single greatest challenge for economists is that there is no “laboratory” in which economic experiments can be carefully controlled, modified and re-tested. The exact conditions under which any economic event happens, happens only once. Technology and politics in particular are ever-changing and evolving, preventing any economic experiment from ever being run twice in the same way. The growing frequency and magnitude of programs invented by politicians to achieve their political objectives with seemingly little concern for debt spending —as evidenced by the U.S. government’s suspending or increasing the government’s debt ceiling 16 times since 2008 — is just one example of the powerful influences that complicate the ability of economists to be able to precisely model the economy and from there carefully steer it in a desirable direction.

That there remains to this day competing economic theories regarding the relationship between monetarism and how markets work is clear proof that there is still much to learn about the net effect when countless individuals, corporations and government actors all act in their own self-interest. For an entity such as the Federal Reserve to therefore suggest that they as a limited actor in an ever-more complicated financial system can control inflation to within a 1% or less margin of error is bold, confident, and seemingly reassuring, but not terribly plausible.