Rebound in Vehicle Demand Is Built On Borrowed Money

Consumer purchases of vehicles in the second half of 2020 have been surprisingly strong. In an unexpected move, luxury brands and pick-up trucks have led the rebound. All of this has been made possible by low interest rates and increased borrowing in the auto-loan market.

The recession brought on as a result of COVID-19 is in many ways unique as compared to past recessions. For this reason we must be more careful in how we understand and respond to the current recession and not allow ourselves to think of it as a ‘normal’ recession and especially not as a variation of the Great Recession, an event which is still etched in the minds of many.

The way in which COVID-19 has impacted the automotive industry is exemplary of why those who will be the most successful leaders coming out of this need to keep an open-mind and seek opportunities today, not simply conserve cash and take defensive positions.

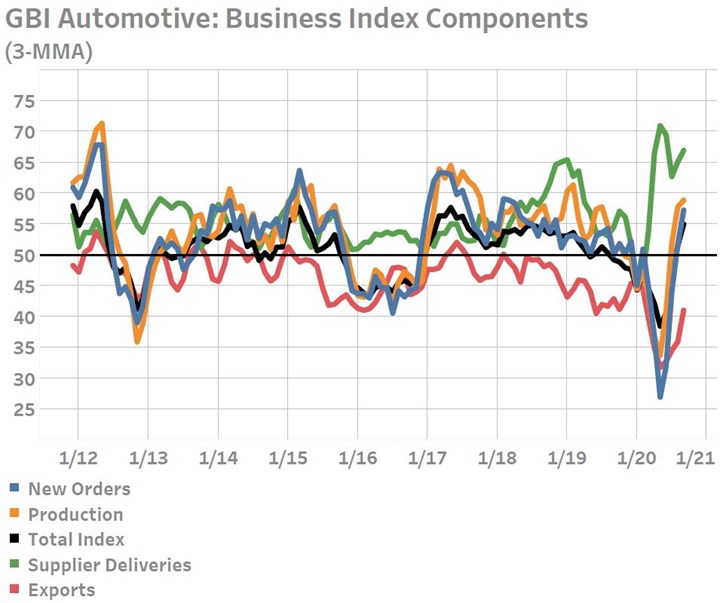

Among manufacturers supporting the automotive industry, Gardner’s Intelligence Business Index data as early as July reported an expanding rebound in new orders and production activity. New orders growth has been driven by domestic demand, conversely, export activity continues to report contracting conditions. The abnormally high readings for supplier delivery activity in 2020 represents a combination of effects; however, the primary effect has been COVID-19's severe disruption of supply chains which has had the unintended consequence of raising this activity reading.

Source: Gardner Intelligence

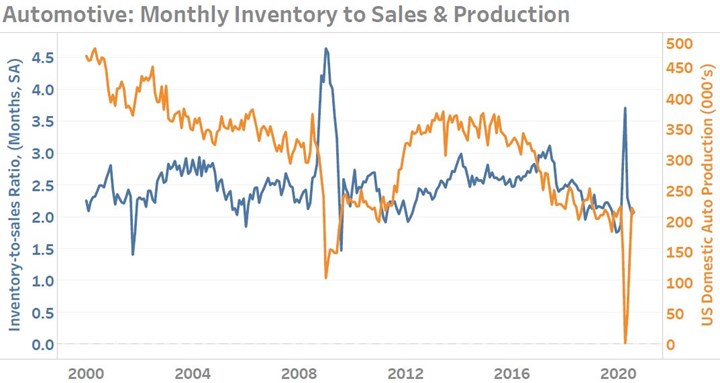

As the economy was put into lockdown during the first-half of 2020, not only did consumption come to an abrupt halt, but so did production. The combination of these events resulted in a near “freeze” of the automotive market for a brief period of time. U.S. vehicle unit sale fell nearly 50% between March and April. Simultaneously, US production fell to below 2,000 units during the same time, a decline of 99.2% from February. The simultaneous “freezing” of both supply and demand pushed the industry towards the unique set of conditions in which it now finds itself. Those conditions are:

1.) Demand for luxury brands and large vehicles is rebounding much faster than for economical, low-profit margin cars. The combination of stimulus checks coupled with reduced spending on social events and for many the continuation of their job -but remotely- has produced a surprisingly strong consumer position.

2.) Vehicle inventories are unusually light for a recession. Inventory-to-sales ratios which spiked in April are already back to pre-recession levels according to the Federal Reserve. In contrast, the industry was plagued with excessive vehicle inventories for nearly a year during the Great Recession, depressing production. 2021 model year vehicles have been particularly difficult for buyers to find with many popular models at historically low inventory levels (measured in days of supply) according to Cox Automotive. Relatively thin inventories and strong demand for such models has put the industry in a better than expected position just months after the apex of the market shock.

Source: Bureau of Economic Analysis (BEA)

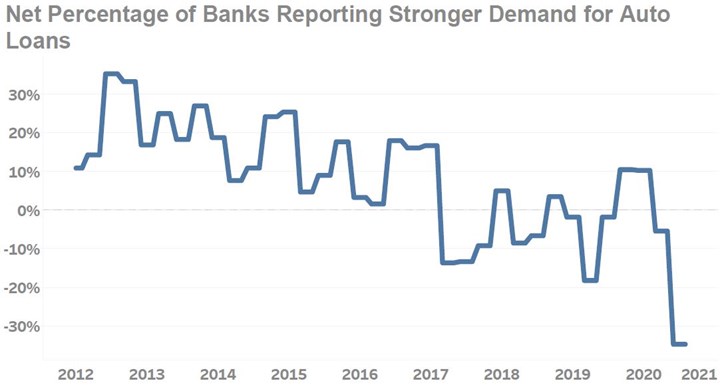

The success of this recent rebound -and its continuation- is in no small part due to the willingness of the finance sector to extend auto credit. The average amount financed for new vehicles has jumped considerably in 2020, rising 18-percent to over $37,000 Between the the end of 2019 and the start of the third quarter. That significantly more of a vehicle’s value is being financed seems at first thought to contrast with the simultaneous fall in demand for automotive loans.

Source: Board of Governors of the Federal Reserve System

Here again the unique nature of this pandemic recession may be at play. This seeming divergence could potentially be explained by the asymmetrical way that this pandemic recession has harmed or spared individuals. Generally speaking, there are those who have been able to adapt their job around COVID restrictions and those who have unavoidably lost their job -or even their company- as a result of government actions taken to fight this pandemic. This bifurcation of individual outcomes combined with strongly increasing asset prices (both homes and equities) suggests that consumer confidence and spending habits at the individual level are far more diverse than would normally be expected during a recession. It is for this reason that macroeconomic measures of the economy seem to contradict one another, making forward-looking decisions by business leaders even more challenging at this time.

.jpg;width=70;height=70;mode=crop)