Money Supply Increases More Than 50% for Second Month

In June, the monetary base was $5.002 trillion, which was slightly lower than last month. However, compared with one year ago, June’s monetary base was up 52.7%.

In June, the monetary base was $5.002 trillion, which was slightly lower than last month. However, compared with one year ago, June’s monetary base was up 52.7%. Therefore, the one-month rate of change was more than 50% for the second month in a row. (In 2009, the monetary base increased more than 100% five times in the first eight months of the year.) This was the seventh month in a row of month-over-month growth. The annual rate of growth accelerated to 10.9% in June, which was the second straight month of accelerating growth.

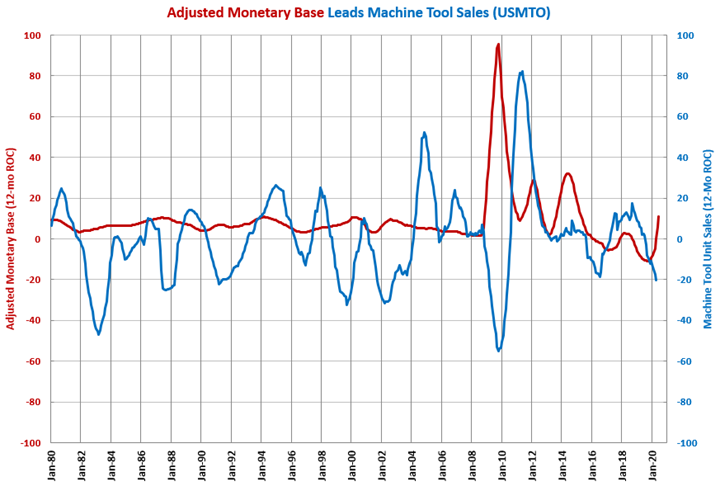

Historically, the annual rate of change in the monetary base leads capital equipment consumption, specifically machine tool orders, by 12-18 months. Although, the lead time between the monetary base and capital equipment consumption shrunk over the last decade.

The recent rapidly accelerating growth in the monetary base should eventually lead to accelerating growth in machine tool orders and capital equipment in general. Based on the historical relationship, machine tool orders should bottom sometime between September 2020 and February 2021.

However, it should be noted that the actual unit orders generally remained between 2,000 to 2,800 units since 2000 except for the significant recessions following the dot com and housing bubbles. In this absolute sense, the larger and larger increases in the money supply have led to smaller and smaller increases in machine tool orders and capital equipment consumption.

.JPG;width=70;height=70;mode=crop)