Money Supply Growth Continues to Accelerate

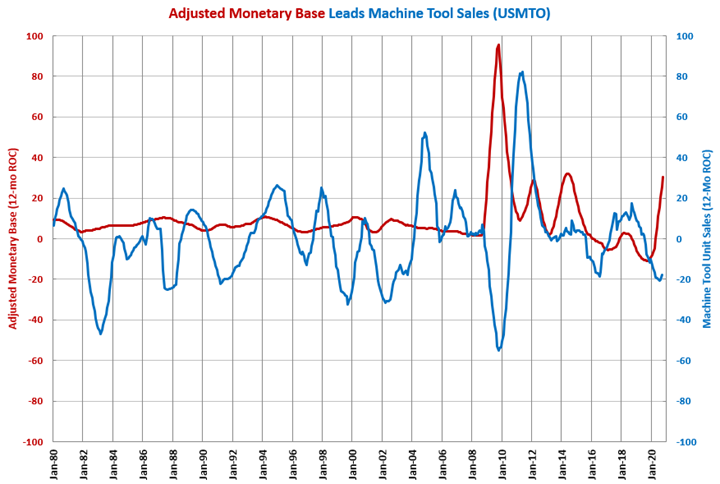

The accelerating growth in the money supply is indicating growth in capital equipment consumption.

In October, the monetary base was $4.917 trillion, which was an increase from the previous month but still below the peak in June. Compared with one year ago, October’s monetary base was up 51.2%, which was the second month in a row and fourth in the last six months with faster than 50% growth. This was the seventh consecutive month that the month-over-month rate of change was faster than 44%. This was the 11th month in a row of month-over-month growth. The annual rate of growth accelerated to 30.4% in October, which was the seventh straight month of accelerating growth and the fastest rate of growth since August 2014.

Historically, the annual rate of change in the monetary base leads capital equipment consumption, specifically machine tool orders, by 12-18 months. Although, the lead time between the monetary base and capital equipment consumption shrunk over the last decade.

The recent rapidly accelerating growth in the monetary base should eventually lead to accelerating growth in machine tool orders and capital equipment in general. Based on the historical relationship, machine tool orders should bottom sometime between September 2020 and February 2021.

.JPG;width=70;height=70;mode=crop)