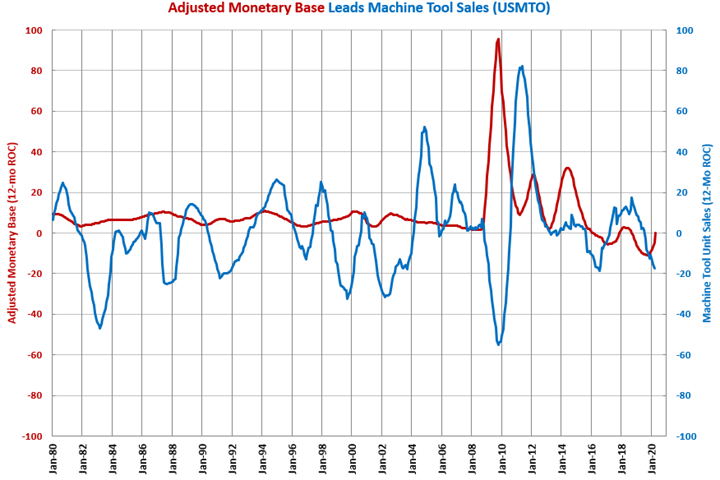

Is the Monetary Base Pointing Toward Higher Capital Spending?

Compared with one year ago, the monetary base increased 47.4%, which was the fastest rate of month-over-month growth since October 2009. This was the fifth month in a row of month-over-month accelerating growth.

In April, the monetary base was $4.885 trillion, which was its highest level ever by nearly $800 billion, or 20% more than the previous all-time high in August 2014. April’s monetary base was $1.4 trillion than it was just two months prior in February. Compared with one year ago, the monetary base increased 47.4%, which was the fastest rate of month-over-month growth since October 2009. This was the fifth month in a row of month-over-month accelerating growth.

The annual rate of change was 0.0% in April, ending 18 months of contraction. Historically, the annual rate of change in the monetary base leads capital equipment consumption, specifically machine tool consumption, by 12-18 months. The lead time between the monetary base and capital equipment consumption shrunk over the last decade. However, the lead time may lengthen again as the money being created may not make its way to capital equipment spending as quickly if the economy remains slow for an extended period of time and banks are reluctant to lend.

.JPG;width=70;height=70;mode=crop)