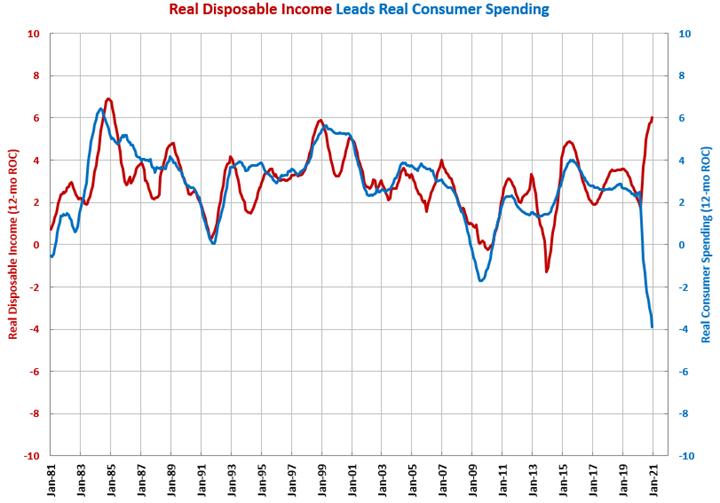

Income Skyrocketing, Spending Crashing

The current relationship between extreme accelerating growth in real disposable income and extreme accelerating contraction in consumer spending is unprecedented.

In December, real disposable income was $15,458 billion. While disposable income was down from the depths of the pandemic, income was still 3.3% higher than one year ago. This rate of month-over-month growth was just below the historic average. The annual rate of growth, in a near-vertical climb, accelerated to 6.0%. This was the fastest rate of annual growth since March 1985.

Of course, the incredible growth in disposable income is solely due to government stimulus checks and extended and enhanced unemployment benefits as there have been record levels of initial jobless claims and entire industries virtually shut down since the start of the pandemic. The growth in income is likely to continue with another round of stimulus checks hitting in January 2021. Currently, the amount is $600, but there is a push to increase the amount by an additional $1,400.

Normally, this kind of acceleration would lead to a dramatic increase in consumer spending. Instead, total consumer spending is contracting, in the opposite vertical direction as disposable income, at the fastest rate since the data started in 1959. So, we have the fastest “income” growth in 35 years and the fastest contraction in consumer spending since the data started more than 60 years ago.

Clearly, the economy is anything but “normal.” And, returning it to “normal” will not be a simple task.

.JPG;width=70;height=70;mode=crop)