Federal Programs to Help People Handle Debts Creating Unusual Credit Market Signals

Federal programs designed to help the country's financially worse off borrowers from overwhelming debt burdens are generally working. These programs are proving to help the economically hardest hit and most vulnerable to the pandemic; however, the number of borrowers facing some form of long-duration credit stress is insidiously accelerating.

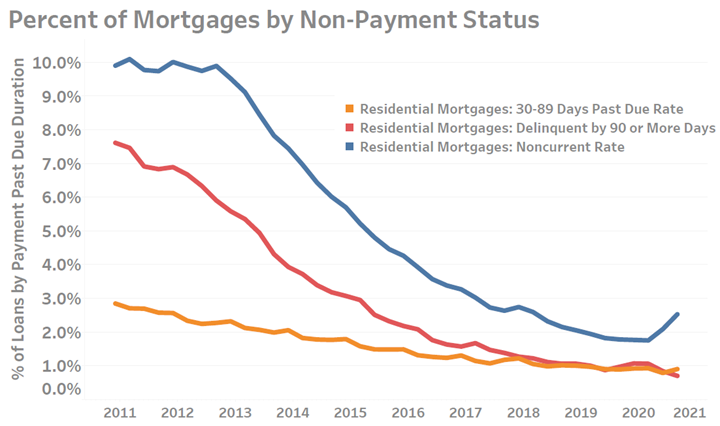

Default and debt past-due metrics for several types of loans are presently at multi-year historic lows, which is anachronistic considering that the world is presently experiencing a global recession. The history of finance and economics is, of course, replete with examples of borrowers failing to meet their debt obligations when economies stumble. However, debt forbearance and other government aid policies enacted during 2020 have thus proven to be potent — at least from a macroeconomic perspective — at keeping a far worse credit collapse scenario from unfolding. However, data measuring other than the most severe forms of late-payment and delinquent debts are still flashing warning signals. What should be done as a result of this is a difficult but essential question the country must answer.

Two credit markets that were significantly altered through government intervention in 2020 included the housing and student loan debt markets. The default rates for both drastically changed in the six months following the start of the pandemic. Delinquent (loans with payments 90-days or more past due) student loan debt fell from 10.75% to 6.5% of all such loans, a rate last observed in early 2005. In a similarly aggressive manner, delinquent mortgages were nearly cut in half while the percentage of mortgages 30-89 days past due remained largely unchanged. The steep fall in the rate of delinquent debts suggests that federal programs had, and continue to have, the intended affect of protecting those who were immediately vulnerable to the financial shocks caused by COVID. In fact, the Wall Street Journal article “Saved Stimulus Checks Expected to Help Spur Economic Recovery” published on January 25th, 2021, reported that 34% of first stimulus checks were used to pay down debt, second only to saving them at 36%.

While fewer current loans are becoming delinquent, there is a growing proportion of noncurrent loans which suggests cracks are forming in the credit markets.

Fewer 90-day Delinquent Borrowers Does Not Mean All Is Well

Less publicized is the noncurrent rate for these same loan types which continued to move higher through at least the third quarter of 2020 — the latest date for which data are available. This rise suggests that there are still cracks in the credit market that are not being addressed and could represent a more insidious form of credit stress. Such a signal may suggest that there is an additional need for continuing stimulus relief in 2021, or the economy may face the prospect of today’s noncurrent borrowers becoming tomorrow’s delinquent borrower

|

Latest Reported Noncurrent Rate [3Q20] (Rate change vs. 1-Yr Ago): |

|

| Home Mortgage | 2.53% (up 42%) |

| Auto Loans | 0.55% (up 18%) |

| All Other Leases | 0.75% (up 44%) |

The current situation brings to the forefront the question: could credit markets continue to remain in their presently “liquid” state without both the stimulus and the forbearance programs presently in-place? If even one of these programs were ended would it result in a freezing of credit markets and if “yes”, then how can the country escape the cycle of sustained government borrowing, potentially in the trillions of dollars, just to keep markets — and by extension an already struggling economy — from not collapsing?