Durable Goods Spending Growth Fastest Since Sept. 1985

January durable goods spending got a significant boost from stimulus checks, a strong stock market, and interest rates that are still historically low.

In January, real consumer durable goods spending was $2,148.4 billion, which was an all-time high. Compared with one year ago, durable goods spending increased 17.1%, which was the fastest rate of month-over-month growth since September 1985. In the seven of the last eight months, month-over-month growth was more than 11%. The only exception was December when the growth rate was still 9%, nearly double the historic average. The annual rate of growth accelerated for the eighth straight month to 7.2%, which was the fastest rate of growth since November 2018.

While durable goods spending grew at an accelerating rate since the economic lockdowns started, total consumer spending contracted at an accelerating rate. Therefore, durable goods spending accounted for its highest percent of total consumer spending ever – 16.3% in December. Multi-decade trends show that durable goods spending steadily increased its share of total consumer spending while services decreased its shares. While the workforce may be trending toward a service economy, consumer spending is trending toward a manufacturing economy.

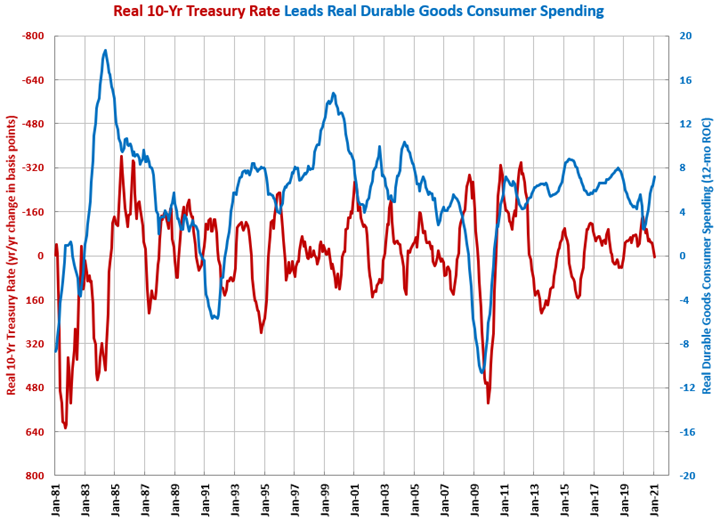

The real 10-year Treasury rate, which is the nominal rate minus the rate of inflation, was -0.07%. This was the 13th consecutive month and 16th of the last 18 that the real rate was negative. However, the rate was grinding slowly higher since April. January’s real rate was the highest since December 2019, which was the last time the real 10-year Treasury rate was positive.

In January, the year-over-year change in the real rate was 6 basis points, which was the first time that the change was positive since December 2018. As much as the absolute level of interest rates, it is the relative change in interest rates that drives additional borrowing and spending. A rising change in the real 10-year Treasury rate tends to be a negative signal for durable goods manufacturing.

Below are key spending categories that lead the most important manufacturing new orders and production indices.

Accelerating Growth: durable goods, food/beverage, motor vehicles/parts, other non-durable goods, pleasure boats

Decelerating Growth: appliances, electronics

Accelerating Contraction: air transportation services, medical care, total consumer

Decelerating Contraction: clothing/footwear

.JPG;width=70;height=70;mode=crop)