Durable Goods Contraction Near Turn Upward

New orders for real durable goods totaled $225,331 million in June. This was more 25-40% more than April and May when many states closed their economy.

New orders for real durable goods totaled $225,331 million in June. This was more 25-40% more than April and May when many states closed their economy. And, June’s durable goods orders were roughly equal to the average durable goods orders in the first quarter of 2020. However, durable goods orders were still 11.6% below June 2019. This was the slowest rate of contraction in the last four months.

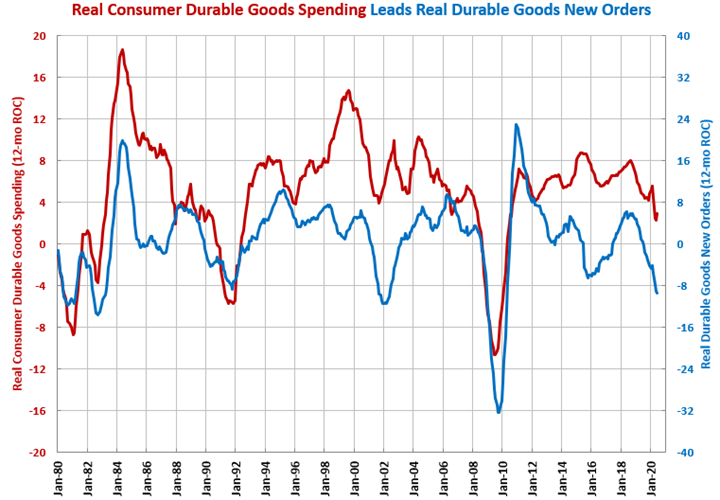

The result was that the annual rate of change contracted 9.4%, which was the fastest rate of annual contraction since April 2010. However, the all-time high consumer durable goods spending in June means that durable goods new orders are indicating a bottom in the rate of contraction in durable goods new orders may be near.

It’s important to note that aerospace orders in May were negative, meaning that there were more cancellations than there were new orders for commercial aircraft, for the third month in a row.

Accelerating Growth: appliances, ship/boat building

Decelerating Growth:

Accelerating Contraction: aerospace, construction materials, durable goods, fabricated metal products, machinery/equipment, motor vehicle/parts, oil/gas-field/mining machinery, power generation, total capital goods

Decelerating Contraction: computers/electronics, HVAC, off-road/construction machinery, primary metals

.JPG;width=70;height=70;mode=crop)