Cutting Tool Orders May Have Reached Low Point

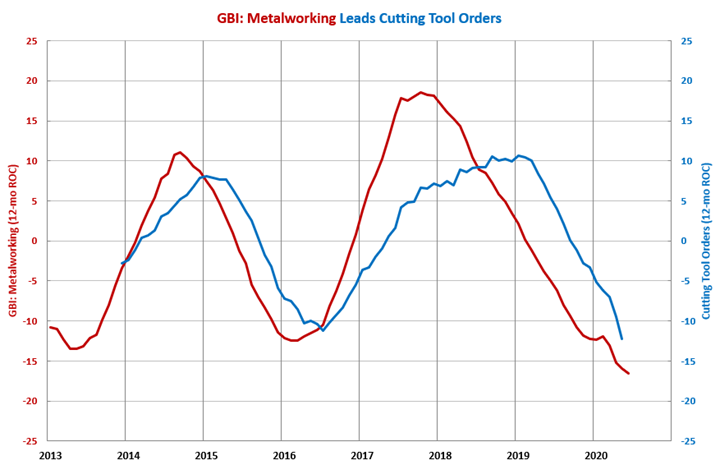

The pandemic accelerated the contraction in metalworking and extended the accelerating contraction in cutting tool orders. But, the GBI: Metalworking indicates the lows in cutting tool orders may be in the past.

In May 2020, real cutting tool orders were $136.6 million, which was the sixth time in seven months that orders were below $190 million. Also, this was the lowest level of cutting tool orders since the data was made public in January 2012. Compared with one year ago, cutting tool orders contracted -36.5%, which was the 15th consecutive month of month-over-month contraction. Also, this was the fastest rate of month-over-month contraction since the data was made public and the second month in a row that contracted faster than 30%.

The annual rate of change contracted at an accelerating rate for the eighth month. The annual rate of contraction was 12.3%, which was the fastest rate of annual contraction since the data was made public. At the beginning of 2020, the Gardner Business Index: Metalworking indicated that the annual rate of contraction in cutting tool orders would bottom out in the summer of 2020. However, the pandemic accelerated the contraction in metalworking and extended the accelerating contraction in cutting tool orders.

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. The annual rate of change in the Index has contracted for 16 straight months, clearly indicating that the annual rate of contraction in cutting tool orders will continue to accelerate. While it is still contracting (an index level below 50), the GBI: Metalworking increased in May and June. Therefore, a bottom in the rate of change in the index should be reached soon. It appears that rate of change in cutting tool orders will bottom out in the late third quarter or fourth quarter of 2020.

.JPG;width=70;height=70;mode=crop)