Cutting Tool Orders Contract at Slowest Rate Since March 2020

The annual rate of contraction decelerated for the sixth straight month, indicating that the annual rate of contraction in cutting tool orders should bottom in the first quarter of 2021.

In November 2020, real cutting tool orders were $151.3 million, contracting 20.7% from November 2019. However, this was the slowest rate of contraction since March 2020. November was the 21st consecutive month of month-over-month contraction, but these same figures clearly show that the contraction is slowing.

The annual rate of change contracted at an accelerating rate for the 14th month. The annual rate of contraction was 21.5%, which was the fastest rate of annual contraction since the data was made public. While the annual rate of contraction continued to accelerate, the one-month and three-month rates of change contracted at a slower rate, indicating that a bottom in the annual rate of contraction is near.

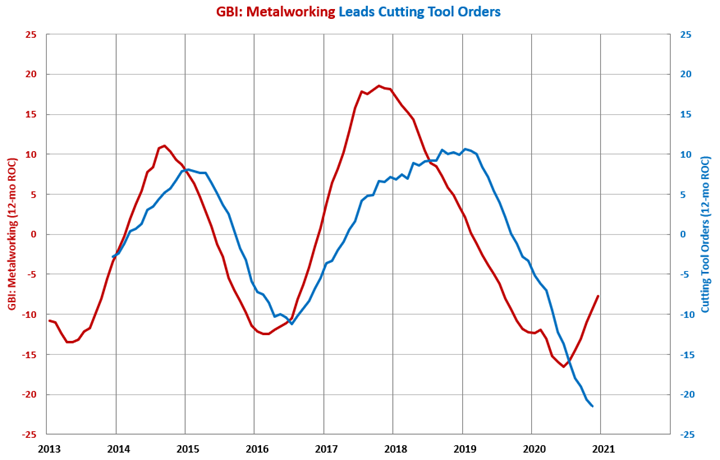

The GBI: Metalworking is a good leading indicator of cutting tool orders and leads cutting tool orders by seven to 10 months. In December, the month-over-month rate of change in the index grew for the fifth consecutive month, growing at its fastest rate since December 2017. The annual rate of contraction decelerated for the sixth straight month, indicating that the annual rate of contraction in cutting tool orders should bottom in the first quarter of 2021.

.JPG;width=70;height=70;mode=crop)