Capacity Utilization Takes a Dip in February

In February, durable goods capacity utilization was 71.9%, which was the lowest rate of capacity utilization since October 2019. However, it should rebound in March.

In February, durable goods capacity utilization was 71.9%, which was the lowest rate of capacity utilization since October 2019. Some of this drop in this capacity utilization rate was due to the winter storm in the midwest and supply chain disruptions, particularly regarding computer chips. Compared with one year ago, capacity utilization contracted 4.0%, which was the fastest rate of contraction since September 2019.

The annual change in durable goods capacity utilization contracted at an accelerating rate. The annual rate of contraction of 9.5% was the fastest since March 2010. However, it seems clear that the annual rate of change is bottoming out. As the annual rate of change tends to lead capital equipment consumption by seven to 10 months, capacity utilization is signaling a bottom in the annual rate of change in capital equipment about the second quarter of 2021.

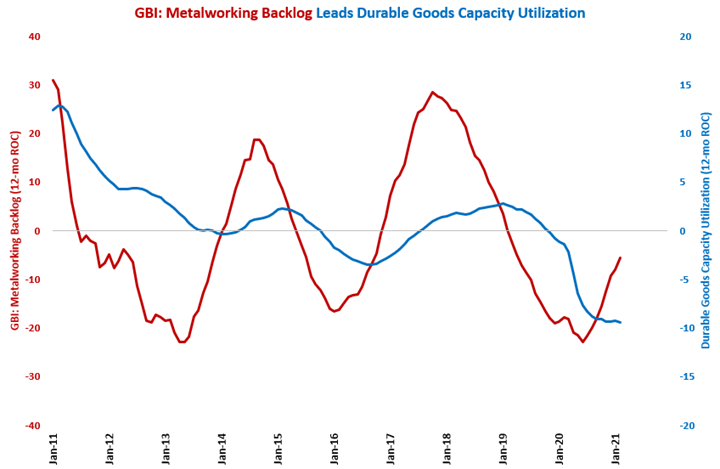

The GBI: Metalworking backlog index tends to lead the annual rate of change in capacity utilization by seven to 10 months. In February, the backlog index was above 50, indicating growth in backlogs, for the third straight month. The backlog index grew 20.2% compared with one year ago. This was the sixth straight month of growth. The annual rate of contraction in the backlog index reached a bottom in June and has contracted at a decelerating rate for eight months, indicating that the annual rate of change in capacity utilization should see decelerating contraction for most of 2021.

Accelerating Growth:

Decelerating Growth:

Accelerating Contraction: automotive, construction materials, durable goods, electronics/computers, forming/fabricating (non-auto), furniture, petrochemical processors, primary metals, printing, textiles/clothing/leather goods, wood/paper products

Decelerating Contraction: aerospace, custom processors, food/beverage processing, machinery/equipment, plastics/rubber products

.JPG;width=70;height=70;mode=crop)