March Housing Permits at Pre Bubble Bursting Level

It has taken 15 years, unprecedented government stimulus, and a pandemic that drove virtually all office workers to work from home and move out of big cities for housing permits to return to levels seen prior to the housing bubble bursting in late 2006 and early 2007. This is leading to strong growth in the appliance and off-road/construction machinery industries, in particular.

There were 157,600 housing permits filed in March 2021, which was the highest total since August 2006. It has taken 15 years, unprecedented government stimulus, and a pandemic that drove virtually all office workers to work from home and move out of big cities for housing permits to return to levels seen prior to the housing bubble bursting in late 2006 and early 2007. This is leading to strong growth in the appliance and off-road/construction machinery industries, in particular.

Permits filed in March increased 36.0% compared with one year ago, which was the fastest rate of growth since June 2015. Housing permits grew nine of the last 10 months, and in eight of those months, the growth was faster than 11.5%.

Regarding the annual rate of change, February was the 20th straight month of growth and the 12th in the last 14 with growth faster than 5.0%. The annual rate of growth accelerated to 8.7%, which was its fastest rate of growth since April 2016.

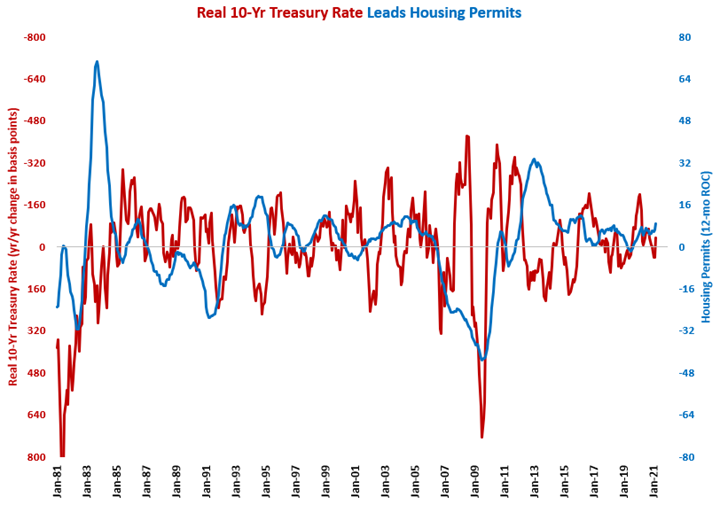

While the nominal 10-year Treasury rate was rising, the real 10-year Treasury rate was falling to its lowest rate since November 2011. The reason for this was that the rate of inflation increased to 2.62% in March, which was the highest rate of inflation since August 2018. As the real 10-year Treasury rate is the nominal rate minus the inflation rate, the real 10-year Treasury rate was -1.01% in March.

After two months in positive territory, the year-over-year change in the real 10-year Treasury rate fell back below 0 to -0.34%. Therefore, the change was negative for 18 of the last 20 months.

The change in the 10-year Treasury rate is a good leading indicator of housing permits and construction spending. A decreasing year-over-year change in the real 10-year Treasury rate typically leads to increases in housing permits.

.JPG;width=70;height=70;mode=crop)