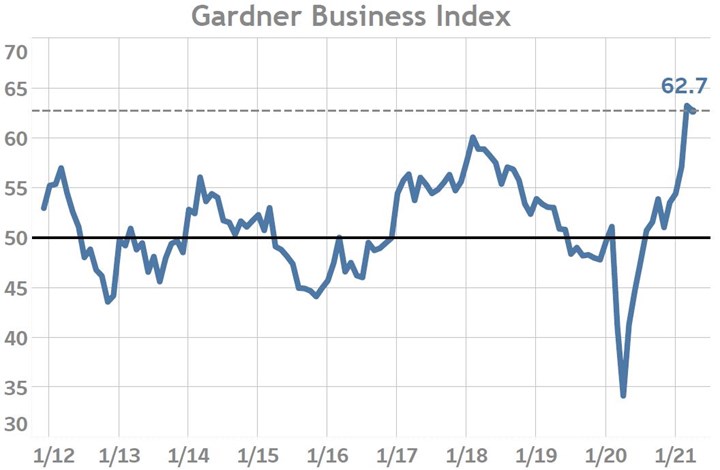

April 2021 GBI: 62.7

The GBI fell slightly after an 8-month trend of accelerating expansion. The latest reading was supported by readings for supplier deliveries, production and new orders but weighed down by employment and exports.

Business Activity Post Modest Deceleration on New Orders and Exports

The April reading of the Gardner Business Index (62.7) declined for the first time since November 2020. The slight decline from the prior month’s revised 63.3 reading resulted from a slowing acceleration in new orders and a slight contraction in export orders. Backlog and employment activity both signaled a slight accelerating expansion in activity which was offset by the slowing expansion of production activity.

The GBI ending April 2021

The latest data signaled that several important changes occurred in the industry during April. The spread between new orders and production narrowed during the month, resulting in backlog activity plateauing between March and April. However, backlog activity readings remain at all-time highs and are presently about 2-points above the prior peak achieved in 2018.

Furthermore, employment activity also plateaued during the month and presently remains 3-points below its all-time high reading. Historically, brief surges in production activity have not resulted in similar surges in employment, thus the latest near record-breaking production readings do not a guarantee that employment is primed to move sharply higher in the near-term. Lastly, export activity contracted after reporting an April record reading of just below 52.

Lastly, supplier delivery activity extended its unprecedented climb higher. April’s reading exceeded 80 for the first time in recorded history. As explained in the recent video available on our website (https://www.gardnerintelligence.com/economics/post/understanding-a-diffusion-index-like-the-gbi) such high readings signal that a tremendous proportion of survey respondents are experiencing slowing order-to-fulfillment times from their upstream suppliers. The latest readings mark a nearly unbroken 10-month chain of slowing fulfillment performance from upstream suppliers.

Gardner Intelligence does its utmost to provide regular and informative updates on the state of manufacturing considering the challenges posed by COVID-19. Gardner cannot thank our survey participants enough for their insights and on-going support. We hope that you will continue to tell us how your businesses are faring. Only through your participation are we able to assess the current state of the industry and where it may be heading. We would encourage our followers and publication subscribers to regularly visit our website blog and connect with Gardner Intelligence on LinkedIn and see our YouTube Channel.

.jpg;width=70;height=70;mode=crop)